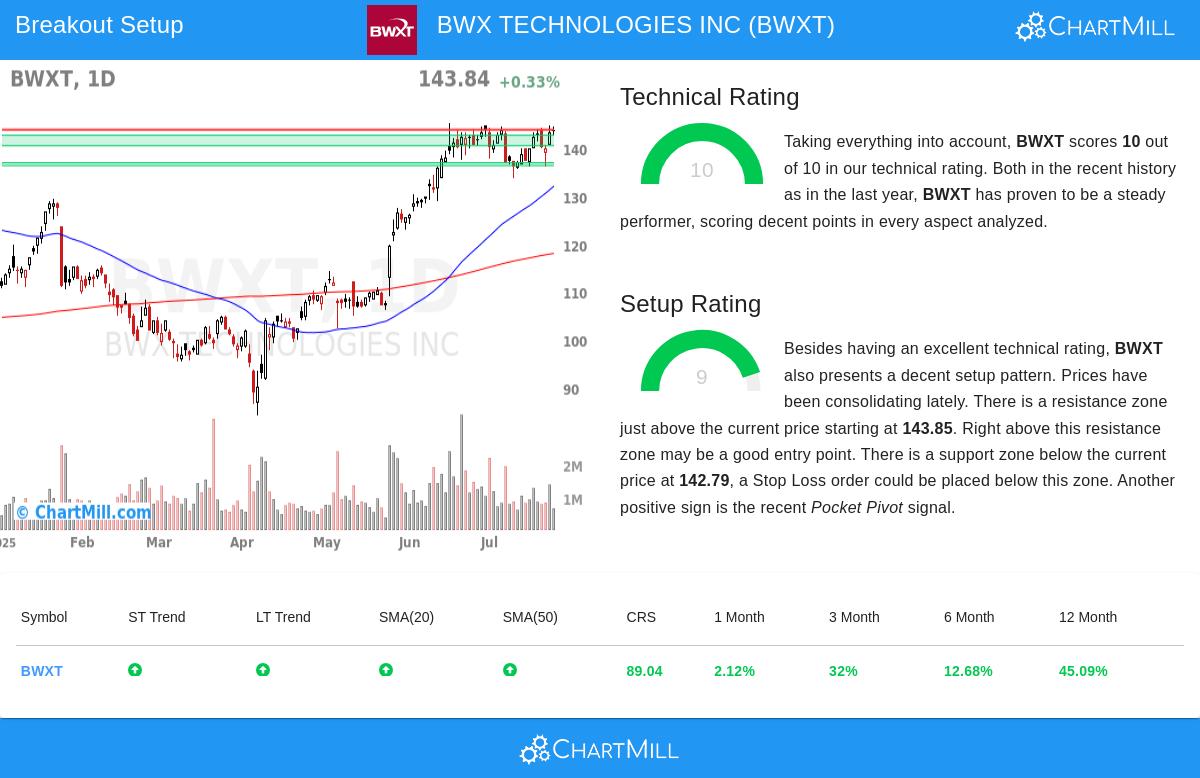

Technical breakout strategies focus on identifying stocks with strong momentum that are consolidating before their next upward move. By using ChartMill's Technical Rating and Setup Quality scores, investors can filter for stocks showing both strong technical health and good entry points. BWX Technologies Inc (NYSE:BWXT) currently fits this profile, with a top score of 10 for technical strength and a high 9 for setup quality.

Technical Strength: A Market Leader

BWXT displays strong technical traits that make it a market leader:

-

Top Technical Rating (10/10): This places BWXT among the highest-rated stocks, with consistent performance across all measured factors. The rating includes relative strength, trend quality, and moving average alignment.

-

Strong Relative Performance: The stock has outperformed 89% of all market stocks over the past year and shows positive trends across all timeframes. Both short-term (20-day) and long-term (200-day) moving averages are rising, confirming momentum.

-

Near 52-Week High: Trading close to its 52-week high of $145.33, BWXT shows no signs of weakening or distribution that often precede reversals. The stock’s ability to stay at high levels suggests institutional backing.

This technical strength is key for breakout strategies, as it highlights stocks likely to continue rising after a breakout, rather than those at risk of false moves or quick pullbacks.

Setup Quality: Consolidation Before Potential Breakout

BWXT’s high Setup Rating (9/10) points to an ideal consolidation pattern:

-

Clear Support/Resistance: The stock has defined support between $140.59-$142.79 and faces resistance at $143.85-$144.07. This tight range sets a potential breakout point at $144.08.

-

Recent Accumulation Signal: A pocket pivot, where price rises on higher volume than recent down days, hints at institutional buying interest—a positive sign before potential breakouts.

-

Stable Volatility: With an Average True Range of 2.37%, BWXT avoids excessive volatility (which raises risk) or stagnant price action (which signals low interest).

For breakout traders, these setup details offer clear entry (above resistance) and exit (below support) points, which are critical for disciplined trading.

Trading Considerations

The technical report highlights:

- Potential breakout entry: $144.08 (above current resistance)

- Stop-loss: $140.58 (below nearest support)

- Risk/reward: 2.43% potential risk on the trade

While the setup looks promising, traders should note:

- The tight stop distance (3.5 points) may require careful position sizing

- The stock has already gained 31.99% over 3 months

- Always check for higher volume on breakout attempts

For investors looking for similar breakout opportunities, the Technical Breakout Setups screen updates daily with stocks meeting these technical criteria.

Disclaimer: This analysis is for informational purposes only and should not be taken as investment advice. Always do your own research and assess your risk tolerance before investing.