The strategy of combining high growth momentum with technical breakout setups aims to find companies displaying both solid fundamental growth traits and favorable chart patterns for possible entry points. This method combines earnings acceleration, increasing profit margins, and positive analyst changes with technically sound stocks consolidating near resistance levels, giving investors chances in names displaying both fundamental health and technical preparation.

Growth Momentum Fundamentals

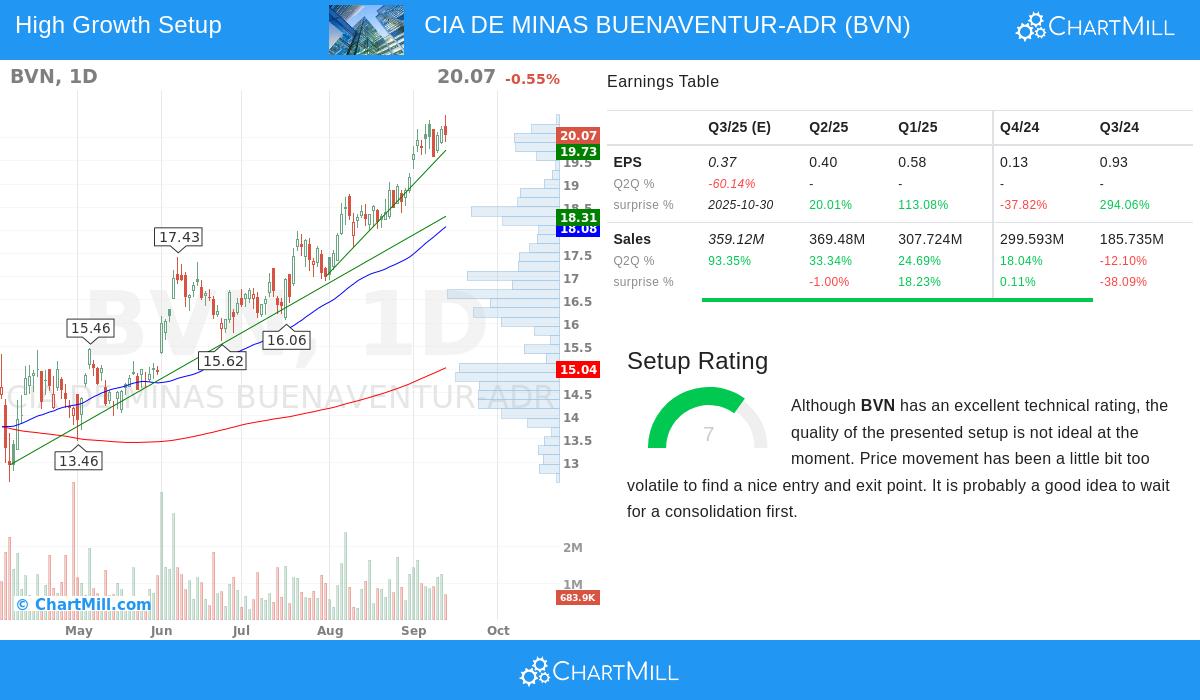

Compania de Minas Buenaventura SAA (NYSE:BVN) displays notable growth traits that fit momentum investing standards. The company's earnings performance shows significant improvement, with trailing twelve-month EPS growth surpassing 424% year-over-year. Quarterly comparisons show steady health, with the most recent quarter showing 32.7% EPS growth compared to the same quarter last year, while earlier quarters displayed even more pronounced growth rates of 129%, 533%, and 954% respectively.

Key fundamental metrics supporting the growth thesis include:

- Free cash flow per share growth of 269% year-over-year

- Revenue growth of 32.2% over the trailing twelve-month period

- Profit margin increase from 2.4% in the prior fiscal year to 34.9% in the most recent full year

- Positive analyst changes with next-year EPS estimates rising 14.6% over the past three months

These metrics show the company's operational betterment and place within the metals and mining sector, where commodity price shifts and operational efficiencies can greatly affect financial performance.

Technical Health and Setup Quality

The technical analysis shows equally notable traits. According to the detailed technical report, BVN gets a perfect technical rating of 10 out of 10, signaling outstanding technical condition across multiple timeframes. The stock shows strong relative performance, doing better than 86% of all stocks in yearly performance while trading near 52-week highs.

The setup quality rating of 7 implies the stock is forming a consolidation pattern that might offer a possible entry chance. Key technical observations include:

- Both short-term and long-term trends are positive

- Price is trading near the high of its recent monthly range between $18.01 and $20.49

- Multiple support zones found between $18.08-$18.31 and $19.60-$20.06

- Resistance is present around $20.08-$20.18, which the stock is currently testing

This technical setup implies the stock has kept its upward momentum while forming a base that might support more progress if resistance levels are broken.

Strategic Alignment

The mix of solid growth metrics and technical consolidation makes BVN especially interesting for momentum investors. The high growth momentum rating of 6 mirrors good fundamental performance across multiple criteria, including earnings growth acceleration, increasing profit margins, and positive analyst changes. These factors are vital for momentum strategies as they signal both past performance and possible future health.

Technically, the stock's consolidation near resistance levels, paired with its perfect technical rating, implies it keeps solid institutional backing while working through a natural pause in its upward movement. This pattern frequently comes before breakout moves, particularly when fundamental conditions stay favorable.

Market Context and Opportunity

With the S&P500 displaying positive trends in both short-term and long-term timeframes, the wider market setting supports continued momentum investing. BVN's place as a metals and mining company offers exposure to commodity cycles while displaying company-specific improvements in operational efficiency and profitability.

The stock's current technical setup, trading near resistance with identified support levels below, provides a defined risk structure for possible entry. The mix of fundamental growth acceleration and technical health creates a notable case for momentum investors looking for companies with both earnings momentum and favorable chart patterns.

For investors looking for similar chances, more screening results combining high growth momentum with technical breakout setups can be located through this specialized screen.

Disclaimer: This analysis is provided for informational purposes only and does not constitute investment advice, recommendation, or endorsement of any security. Investors should conduct their own research and consult with a qualified financial advisor before making investment decisions. Past performance is not indicative of future results.