BOS Better Online Solutions Ltd. (NASDAQ:BOSC) has been identified by a screening process using the CANSLIM investment methodology. This systematic process, created by William O'Neil, uses fundamental and technical analysis to find companies with good earnings growth, new products or services, and notable institutional interest, while also accounting for the general market direction. The method looks for market leaders with increasing business momentum.

Earnings and Sales Momentum

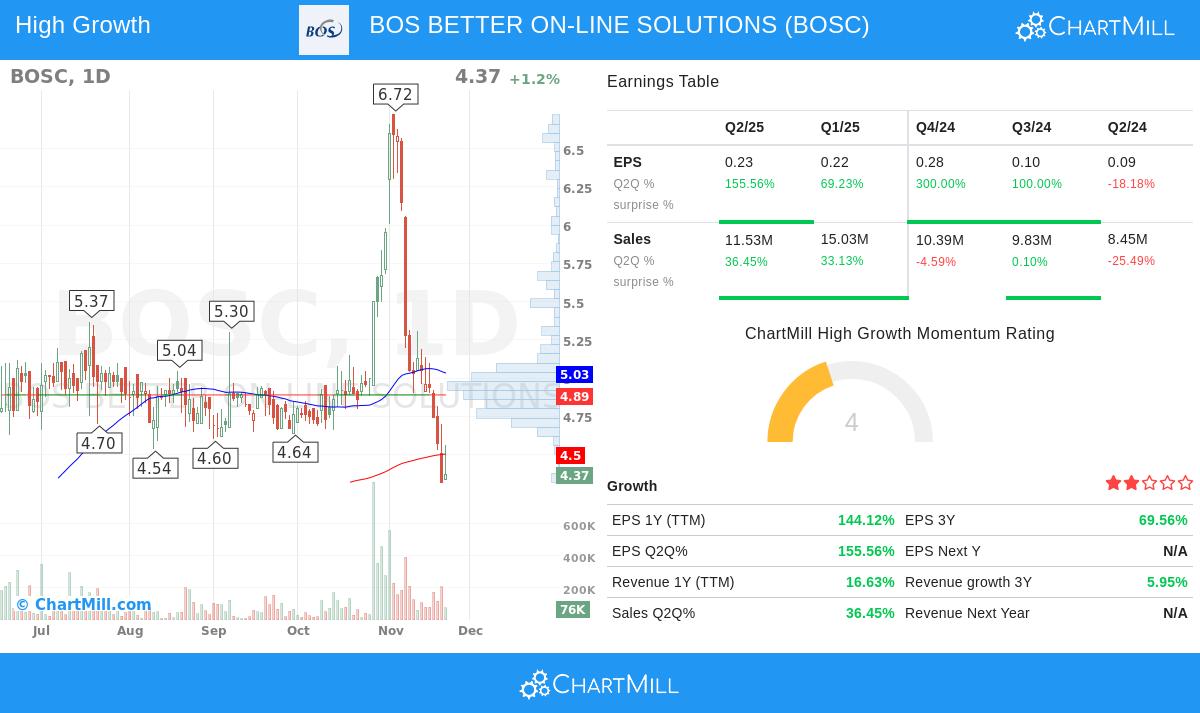

The "C" in CANSLIM highlights current quarterly earnings and sales growth, needing a large increase in business performance. BOSC shows notable strength in this important area:

- Quarterly EPS growth of 155.56% year-over-year

- Quarterly revenue growth of 36.45% year-over-year

- Three-year EPS compound annual growth rate of 69.56%

These numbers are much higher than the CANSLIM minimums of 20-25% for quarterly growth and 25% for annual earnings increases. The significant earnings increase shows the company is in a phase of strong business momentum, a key part of the CANSLIM method that looks for companies with quickly improving fundamentals.

Profitability and Financial Health

The "A" part concentrates on annual earnings increases and profitability measures, while the "S" standard looks at supply factors like debt levels. BOSC offers a varied but mostly good picture:

- Return on Equity of 13.25%, above the 10% minimum requirement

- Debt-to-Equity ratio of 0.04, much lower than the 2.0 maximum limit

- Profit margin of 6.79% placing in the top group of industry peers

The good ROE points to efficient use of shareholder capital, and the very low debt level offers financial stability and lowers risk in times of economic doubt. These measures fit with CANSLIM's liking for companies with lasting profitability and solid balance sheets.

Market Leadership and Institutional Support

The "L" and "I" parts assess market leadership and institutional backing, important for finding stocks with wider market acceptance. BOSC displays encouraging traits in these areas:

- Relative strength rating of 79.13, showing it performs better than nearly 80% of all stocks

- Institutional ownership of 21.22%, much lower than the 85% ceiling

- Good 30% price increase over the last twelve months

The high relative strength confirms the stock's market leadership position, and the reasonable institutional ownership indicates potential for more institutional purchases as the company's profile rises. CANSLIM theory suggests that stocks with increasing institutional interest but not yet widely known often offer the most potential.

Technical and Fundamental Assessment

From a technical viewpoint, BOSC gets a rating of 2 out of 10, showing recent price softness in spite of good longer-term performance. The stock has fallen about 11% over the past month and is trading close to the bottom of its recent range. The setup quality score of 3 implies limited consolidation patterns at this time, which makes timing purchases difficult.

Fundamentally, the company scores 4 out of 10, with specific strength in profitability measures but some questions about financial health. The valuation seems attractive with a P/E ratio of 5.27, considerably below industry and market averages, although this might reflect the company's smaller scale and particular industry factors.

Market Context and Considerations

The "M" in CANSLIM reminds investors to think about the overall market direction. At present, the S&P 500 displays a negative long-term trend despite recent short-term gains. This uncertain market setting demands careful position sizing and disciplined risk management, especially for smaller capitalization stocks like BOSC.

While BOSC satisfies several CANSLIM criteria through its outstanding growth rates, solid balance sheet, and market leadership traits, investors should be aware of the stock's recent technical softness and smaller size, which could lead to higher volatility. The lack of analyst estimates for future growth also creates difficulties for forward-looking analysis.

Finding Additional Opportunities

For investors wanting to find other companies that satisfy CANSLIM criteria, more screening results can be accessed through our pre-configured CANSLIM stock screener. This tool enables further adjustment based on specific investment choices and market situations.

For detailed analysis, readers can review the full technical analysis and fundamental analysis reports for BOSC.

Disclaimer: This article presents objective analysis based on publicly available data and should not be seen as investment advice, recommendation, or endorsement of any security. Investors should perform their own research and talk to financial advisors before making investment decisions.