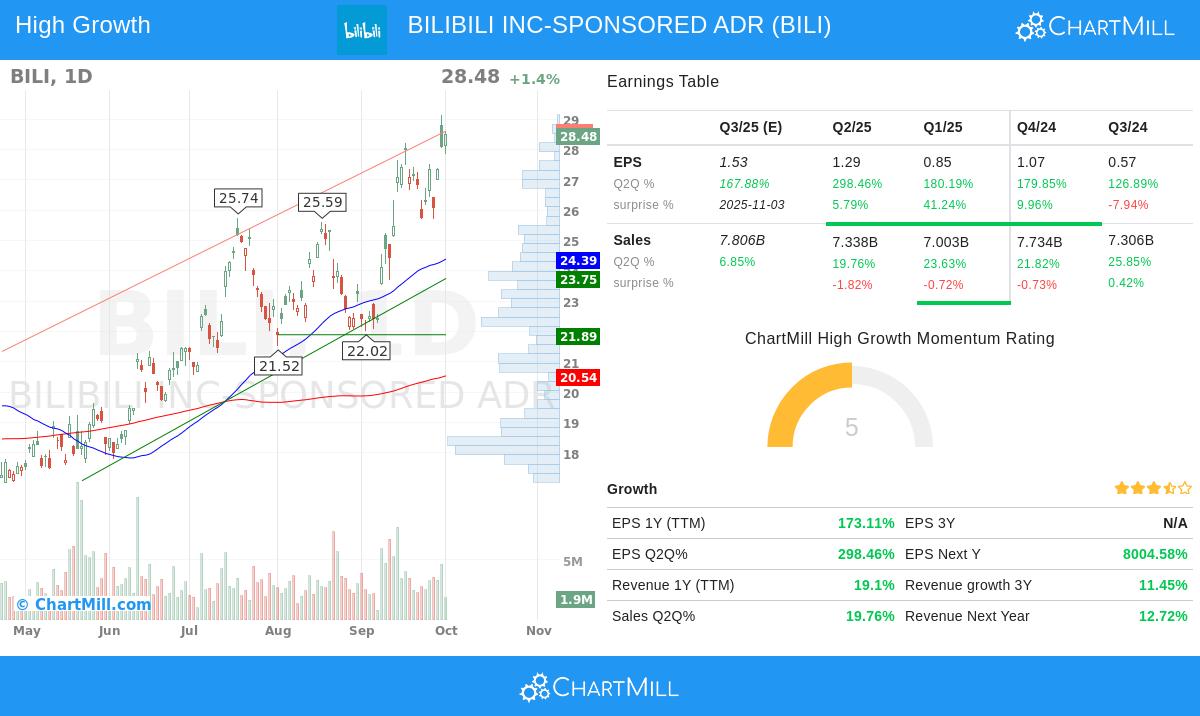

Bilibili Inc (NASDAQ:BILI) has become an interesting option for investors using systematic growth strategies, meeting strict technical and fundamental standards through a combined screening process. The selection process joins Mark Minervini's Trend Template for technical health with High Growth Momentum measures to find companies displaying both strong price momentum and improving business fundamentals.

Technical Strength Through Trend Template

Bilibili shows very good technical features that match well with Minervini's systematic method for finding stocks in clear uptrends. The Trend Template needs stocks to show specific moving average arrangements and relative strength measures to confirm they are in definite Stage 2 advances, not short-lived recoveries.

The stock meets all important moving average conditions:

- Current price ($28.48) trades well above the 50-day ($24.39), 150-day ($21.23), and 200-day ($20.54) moving averages

- All major moving averages show upward slopes, confirming continued momentum

- The 50-day MA sits above both the 150-day and 200-day MAs, showing correct order across timeframes

- The stock trades 96.8% above its 52-week low while remaining within 2.2% of its 52-week high

These technical features are important because Minervini's research indicates that stocks showing such formations often continue their advances, as institutional buying creates these particular technical marks. The arrangement indicates the stock has both improved significantly from its lows and keeps momentum close to new highs, a pairing that has often come before more price gains.

Notable Growth Path

Beyond technical health, Bilibili displays the fundamental improvement that High Growth Momentum investing aims to find. The company's financial measures show a business seeing major operational betterment and earnings momentum.

The earnings growth narrative is especially strong:

- EPS growth quarter-over-quarter reached 298.5% in the most recent quarter

- Previous quarters showed growth rates of 180.2%, 179.9%, and 126.9% respectively

- Full-year EPS growth improved to 99.2% in the most recent fiscal year

- The company exceeded EPS estimates in three of the last four quarters by an average of 7.4%

Revenue growth supports this earnings surge:

- Quarterly revenue growth maintains good momentum at 19.8% in the latest quarter

- Previous quarters showed growth rates of 23.6%, 21.8%, and 25.8%

- Full-year revenue growth improved to 19.1% after slowing to 2.9% in the prior year

This improvement formation is key because Minervini notes that the top-performing stocks usually show getting better fundamentals at the same time as technical breakouts. The pairing indicates institutional investors are seeing the fundamental betterment and taking positions.

Profitability and Cash Flow Change

Maybe most importantly, Bilibili shows a major shift in profitability measures that often comes before continued price gains. The company has changed from considerable losses to meaningful profitability, with profit margins becoming positive at 1.2% in the latest quarter.

Free cash flow creation shows even more notable betterment:

- Free cash flow per share reached $1.45 on a TTM basis

- Year-over-year free cash flow growth increased by 500.5%

- This cash flow change suggests the business model is developing and becoming self-supporting

These profitability measures are vital because Minervini's research shows that stocks with improving earnings and getting better margins tend to draw institutional notice, creating the continued buying that drives multi-month or multi-year advances.

Technical Analysis Summary

The technical report gives Bilibili a strong score of 9 out of 10, reflecting very good technical condition across multiple timeframes. Both short-term and long-term trends are positive, with the stock trading near 52-week highs along with the wider market. The stock shows better relative strength, performing better than 81% of all stocks and 72% of its Interactive Media & Services industry peers over the past year.

While the technical base is sound, the setup quality gets a medium 5, suggesting investors could think about waiting for a period of stability before starting positions. The recent price movement has shown some variation, making good entry points harder to find. Six clear support levels have been found between $15.97 and $26.09, providing defined risk management levels for possible positions.

View the complete technical analysis report for detailed support and resistance levels, volume analysis, and other technical measures.

Investment Considerations

For investors using the Minervini method, Bilibili represents an interesting example of matching technical health with fundamental improvement. The stock meets the strict Trend Template conditions that have in the past found leaders in early parts of major advances, while the High Growth Momentum measures confirm the underlying business change.

The mix of very strong earnings growth, improving profitability, good cash flow creation, and technical breakout features creates a profile that growth investors often look for. However, as with any momentum strategy, correct position sizing and risk management stay important, especially given the stock's recent good advance and higher variation.

Discover more High Growth Momentum + Trend Template opportunities through our systematic screening process.

Disclaimer: This analysis is for informational and educational purposes only and does not constitute investment advice. All investments involve risk, and past performance does not guarantee future results. Conduct your own research and consult with a qualified financial advisor before making investment decisions.