For investors using a technical breakout strategy, the goal is to find stocks that are in a solid, confirmed uptrend and are now moving in a narrow range. This mix indicates a stock is resting to build energy before its next possible rise, giving a more distinct entry point with clear risk. The method relies on two specific scores from ChartMill: the Technical Rating, which measures the general condition and trend force of a stock, and the Setup Quality Rating, which evaluates the condition of its present tight pattern. A stock with high marks in both areas is seen as a leading choice for a technical breakout setup.

Bunge Global SA (NYSE:BG) recently appeared in such a search, presenting an interesting case for technical investors. The global agribusiness and food ingredient company is now showing the signs of this strategy.

Technical Strength: A Base of Momentum

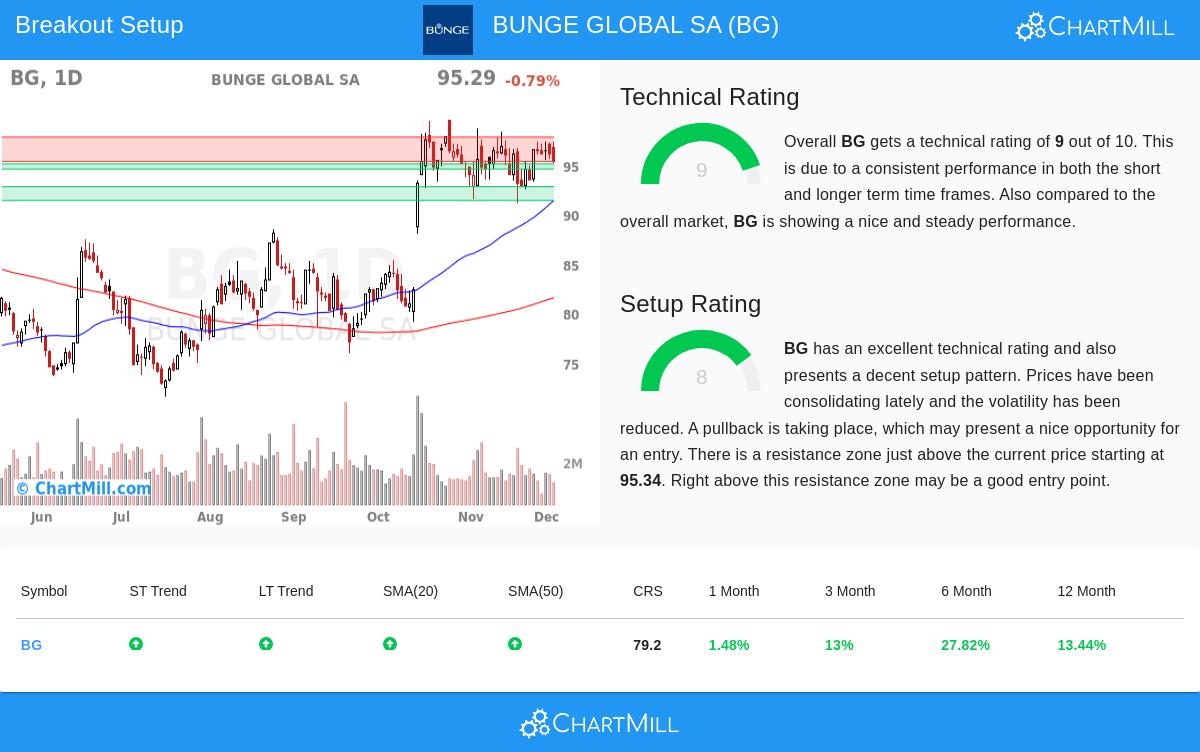

The central idea of a breakout strategy is to trade along the existing trend. Bunge’s technical picture provides a solid base, receiving a high Technical Rating of 9 out of 10. This score shows firm momentum across various time periods and compared to the wider market.

Important elements adding to this rating are:

- Positive Trend Agreement: Both the long-term and short-term trends for BG are labeled positive. This agreement is vital, as it shows continued buying without notable opposing trend softness.

- Firm Relative Performance: The stock is doing better than 79% of all stocks in the market over the last year and a stronger 86% of similar companies in the Food Products industry. This industry-leading force is a sign of possible market leadership.

- Supportive Moving Averages: BG is priced above all its main simple moving averages (20, 50, 100, and 200-day), and each of these averages is rising. This layered agreement of rising support levels is a standard sign of a sound uptrend.

This technical force is needed for the strategy because it raises the chance that any breakout from a tight range will continue in the main direction of the trend, upward. A complete review of these elements is found in the ChartMill Technical Report for BG.

Setup Quality: Finding the Tight Range

While a firm trend is required, it is not enough for a best entry. Buying a stock that has just completed a large, stretched move holds the chance of a quick decline. This is where the Setup Quality Rating becomes important, as it finds times of tight or "narrow" trading. BG receives a Setup Rating of 8, indicating a good pattern.

The analysis states the stock is "showing lower volatility while prices have been moving in a narrow range in the latest period," and specifically finds a "bull flag pattern." This pattern often appears after a firm rise and is marked by a small, downward-tilting tight range, looking like a flag on a pole. It shows a pause where the stock absorbs its recent increases before possibly continuing its uptrend.

The existence of this pattern, along with the high setup score, offers a practical benefit. It lets an investor set a clear entry point just above the tight range's resistance and a reasonable stop-loss point just below its support, thus measuring risk. The automated analysis proposes an entry at $97.81, above a set resistance area, with an exit at $94.57.

Support, Resistance, and Market Setting

The technical report details a specific plan of support and resistance. BG has several support areas below the present price, the closest being between $94.58 and $95.09, which adds reason to possible stop-loss placements. Directly above sits a set resistance area between $95.34 and $97.80. A clear move above this area could be seen as the starting breakout.

It is important to note that while BG is trading in the higher part of its 52-week range, the report states it is somewhat behind the S&P 500, which is trading near recent peaks. Within the setting of a positive general market trend, this could indicate possibility for follow-on momentum if the breakout happens.

Finding More Possible Breakout Setups

Bunge Global SA shows the kind of chance technical breakout screens are made to find: a basically firm trend combined with a helpful pause. For investors looking to use this method to find new ideas each day, the process can be repeated using the Technical Breakout Setups screen. This tool sorts the market for stocks that, like BG, mix high technical and setup ratings.

Disclaimer: This article is for information only and is not investment advice, a suggestion, or an offer to buy or sell any security. The analysis uses technical measures and automated reports. Investors should do their own research, think about their risk comfort, and talk with a financial advisor before making any investment choices. Past results do not guarantee future outcomes.