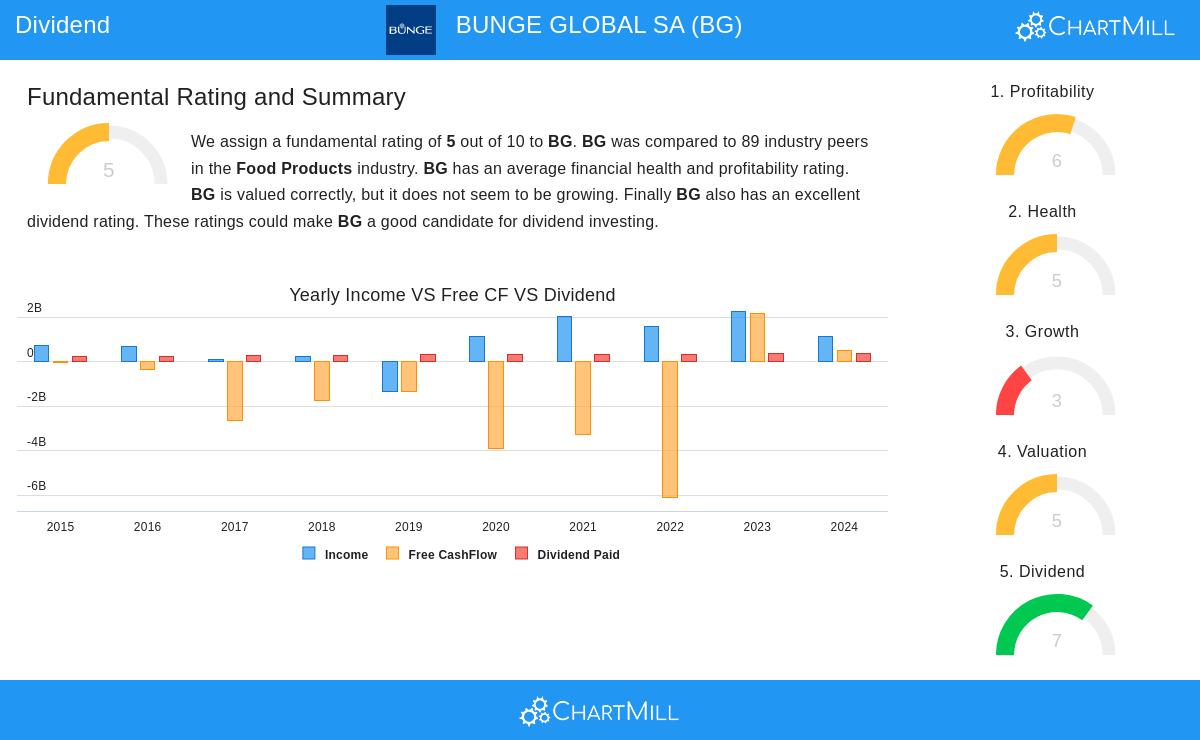

BUNGE GLOBAL SA (NYSE:BG) was identified as a strong dividend candidate by our screening process. The company combines a solid dividend profile with reasonable profitability and financial health, making it an interesting option for income-focused investors.

Dividend Strength

- Attractive Yield: BG offers a dividend yield of 3.79%, which is above the S&P 500 average of 2.39%.

- Reliable Track Record: The company has paid dividends for at least 10 years without reductions, indicating stability.

- Sustainable Payout: With a payout ratio of 34.19%, BG retains enough earnings to support future dividends and growth.

- Modest Growth: The dividend has grown at an annual rate of 3.89%, providing gradual income increases.

Profitability & Financial Health

- Solid Margins: BG maintains an operating margin of 3.03% and a return on equity of 10.34%, reflecting decent profitability.

- Healthy Liquidity: A current ratio of 2.04 and quick ratio of 1.12 suggest the company can meet short-term obligations.

- Reasonable Debt: A debt-to-equity ratio of 0.57 is manageable and in line with industry peers.

Valuation

- Fairly Priced: BG trades at a P/E ratio of 10.23, below both the industry and S&P 500 averages.

- Forward Earnings Support: A forward P/E of 9.07 suggests the stock remains reasonably valued.

While BG’s recent earnings and revenue growth have slowed, its strong dividend history and financial stability make it a candidate for dividend portfolios.

For a deeper look, review the full fundamental report on BG.

Our Best Dividend Stocks screener provides more high-quality dividend ideas.

Disclaimer

This is not investing advice. Always conduct your own research before making investment decisions.