For investors looking for a methodical way to find high-growth market leaders, the CAN SLIM method, created by William O'Neil, is a foundational plan. It mixes strict fundamental study with important technical signs to find stocks with solid earnings momentum, support from institutions, and leading traits, best bought during established market rises. A recent filter using this plan has identified BEL FUSE INC-CL B (NASDAQ:BELFB) as a stock that deserves more attention.

Matching the CAN SLIM Rules

The CAN SLIM system is an acronym, with each letter standing for a key filter. BEL Fuse seems to match a number of these measurable standards, which are made to find companies with quickening business results and market notice.

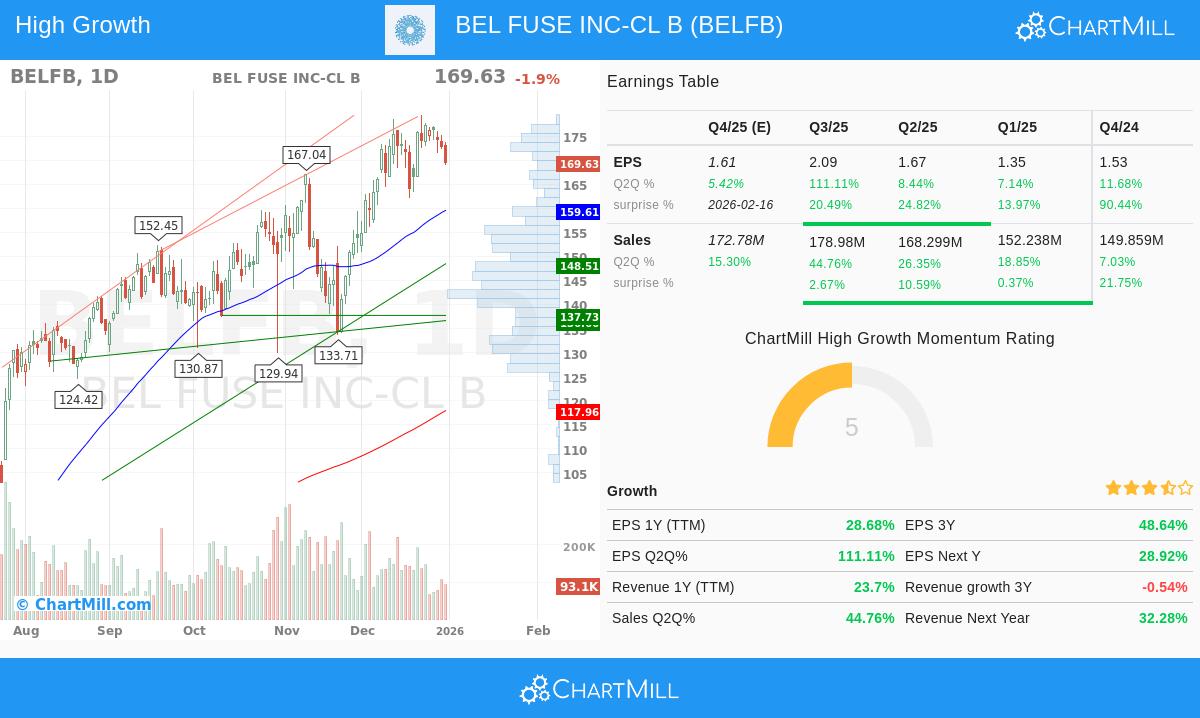

- C - Current Quarterly Earnings & Sales: The plan requires large or quickening growth in the latest quarter. BELFB shows a very high 111.1% year-over-year EPS growth and a strong 44.8% sales growth for its last quarter, well above the common lowest limits of 20-25%. This fast increase is a main sign the plan looks for.

- A - Annual Earnings Increases: To check for steadiness, CAN SLIM wants solid growth over several years. BELFB’s earnings per share have increased at a typical yearly rate of 48.6% over the past three years, showing a forceful and continued growth path that fits well with the plan's look for "big growth."

- N - New Highs & New Products: While "newness" in products or management is a matter of quality, the "New Highs" part is technical. BELFB is now trading close to its 52-week high, a good sign that market momentum sees its fundamental soundness. The company's work on making parts that give power, guard, and link electronic circuits puts it in changing technology areas.

- L - Leader or Laggard: This is judged by relative strength (RS), which matches a stock's price movement to the whole market. A high RS shows leadership. With a ChartMill Relative Strength score of 95.7, BELFB is doing better than about 96% of all stocks, clearly marking it as a market leader, a required feature for CAN SLIM investors.

- I - Institutional Sponsorship: The plan favors stocks with rising institutional ownership, but not so high that all possible buying is done. BELFB’s institutional ownership is at 43.9%, which is much lower than the 85% top limit often used in filters. This points to there being enough space for more institutional finding and buying force.

- S & M - Supply/Demand & Market Direction: On the fundamental side, BELFB keeps a sensible debt picture with a Debt/Equity ratio of 0.53, which is inside the plan's favored span. Importantly, the "M" for Market Direction tells investors to match the general trend. Now, both the long-term and short-term trends for the S&P 500 are good, giving a helpful setting for looking at growth leaders like BELFB.

Fundamental and Technical Summary

A look at BEL Fuse’s detailed reports gives background to the filter's basic numbers.

The company’s fundamental analysis report gives it a good score of 7 out of 10. The study points out a remarkable profit picture, with high Return on Equity (ROE) of 15.2% and growing margins. Growth measures are especially strong, showing very good past EPS growth. While prices seem reasonable next to the market and its field, the report states that BELFB's high profit and expected future growth could support its present levels. This mix of high growth and solid profit is exactly what growth investors aim for.

Technically, the stock is even stronger, getting a top score of 10 out of 10 in its technical analysis report. The report confirms the stock is in good trends across all main time frames and notes it is forming a "acceptable setup pattern," like a bull flag, after its large rise. This suggests the stock might be settling its gains in a sound way, possibly giving a planned entry chance for investors.

A Stock for More Study

Based on the exact measures of the CAN SLIM filter, BEL Fuse Inc. shows a strong picture. It displays the fast quarterly growth, continued yearly earnings gains, high relative strength, and workable institutional ownership that the method values. The good technical setting and positive market conditions further match the system's rules.

It is key to recall that a filter result is a beginning for more careful checking, not a last buy sign. CAN SLIM investors would next examine the company’s field position, competitive edges, and the exact chart pattern for a correct entry point, always using a firm stop-loss rule as the system requires.

Interested in looking at other stocks that now pass this growth-centered filter? You can see the live CAN SLIM filter results here.

Disclaimer: This article is for information and learning only and does not make up investment advice, a suggestion, or a deal or request to buy or sell any securities. The study shown is based on given data and should not be the only ground for any investment choice. Investors should do their own full study and talk with a skilled financial guide before making any investment choices. Past results do not show future results.