For investors looking for steady income, a methodical selection process can find stocks that provide more than a high listed yield. A frequent method uses filters for firms with a good total dividend record, as judged by a thorough rating system, while confirming they also keep good basic business strength and earnings. This method tries to sidestep the dangers of high-yield traps, where a rising yield frequently warns of a falling stock price and possible dividend reductions, and instead concentrates on lasting payments backed by a firm financial base.

Booz Allen Hamilton Holding Corp. (NYSE:BAH) appears from such a filter, presenting a profile that fits this careful dividend-investing approach. As a top provider of management and technology consulting services to U.S. government agencies and business customers, its operational model offers a measure of steadiness that is appealing for portfolios focused on income.

A Good Dividend Profile

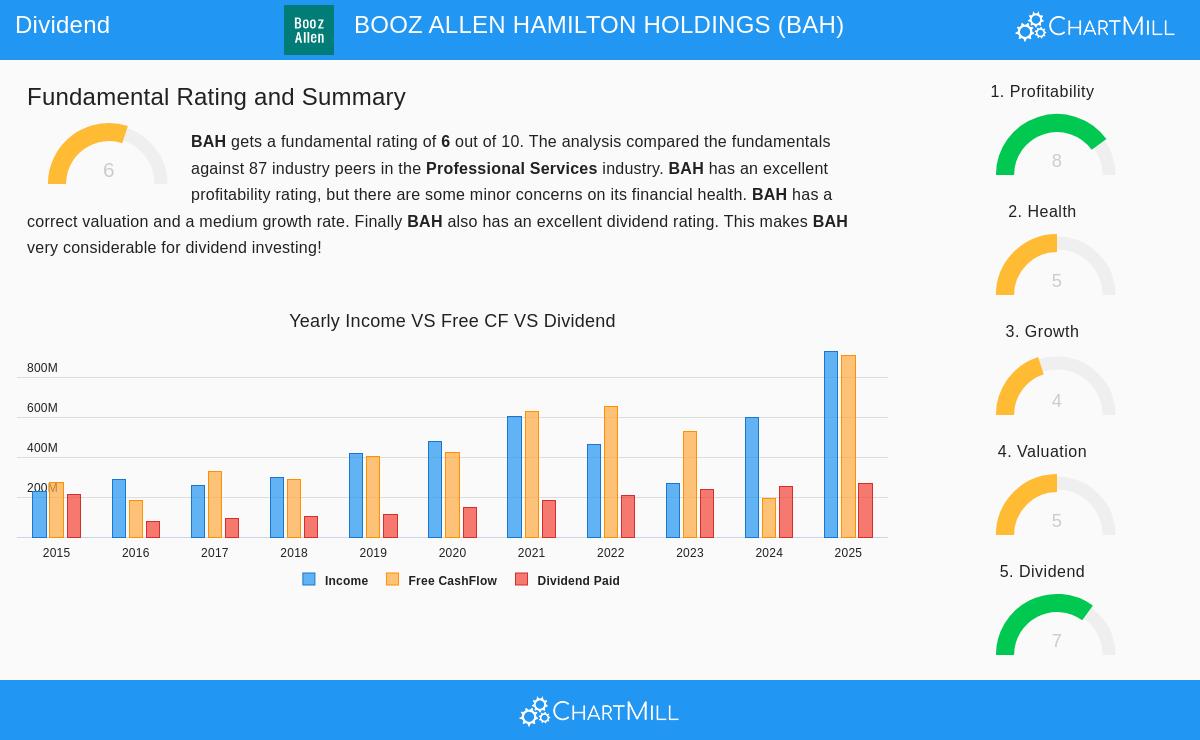

The center of the investment case for BAH rests on its dividend, which receives a high mark due to a number of main elements important for longevity and increase.

- Dependable History: The company has built a reliable past, having paid and, notably, raised its dividend each year for at least ten years. This steady pattern is a sign of dividend dependability.

- Appealing and Increasing Payment: With a present yield near 2.64%, BAH gives a satisfactory income flow that exceeds the yield of many similar firms in the professional services field. More notably, the dividend has risen at an average yearly pace of almost 15% over the last five years, showing a dedication to giving greater value to shareholders.

- Manageable Payout Ratio: A vital test for any dividend stock is the payout ratio, the part of profits paid as dividends. BAH’s ratio is at a manageable 33%, showing the company keeps enough profits to put back into the business while paying the dividend, without straining its funds.

You can see the complete details of these measures in the detailed fundamental analysis report for BAH.

Backed by Good Profitability

A rising, lasting dividend must be paid for by a profitable company. BAH does well here, with high scores for profitability that confirm its capacity to produce the cash required for shareholder payments.

- Notable Returns: The company gets excellent marks for Return on Equity (ROE) and Return on Invested Capital (ROIC), doing much better than most of its industry. High ROIC, especially, shows effective use of capital to create profits.

- Good and Widening Margins: BAH keeps good profit, operating, and gross margins next to its sector. Also, these margins have displayed gain in recent years, a good signal of operational effectiveness and pricing strength.

This profitability is fundamental. It makes sure the dividend is not paid from borrowed money or shrinking cash holdings but is a share of actual company earnings, which is necessary for the lasting strength of an income investment.

Keeping Sufficient Financial Condition

While the filter looks for "acceptable" condition to steer clear of financially pressured companies, it is useful to look at the specifics. BAH’s financial condition rating shows a varied but workable situation.

- Liquidity Position: The company displays no immediate liquidity worries, with current and quick ratios that are good and superior to most industry rivals, implying it can easily meet its upcoming responsibilities.

- Debt Points: The analysis mentions a high debt-to-equity ratio, showing a notable use of debt financing. Yet, this is partly balanced by a strong Altman-Z score, which indicates a low immediate chance of financial trouble. The main point is that while the capital setup uses debt, the company’s sizable profitability and cash flow creation supply the ability to handle this debt.

For a dividend investor, this highlights the value of the filter rules: the plan specifically asks for a base level of financial condition to remove companies where high debt could endanger future payments, even if present dividends seem appealing.

Price and Increase Setting

From a price standpoint, BAH seems fairly valued. Its Price-to-Earnings (P/E) ratio is under both the industry and the wider S&P 500 averages, suggesting the stock is not priced too high relative to its earnings. This offers a buffer for new investors.

The increase view is more conservative. While past revenue and EPS increase have been good, analyst forecasts for the next years are for small, single-digit increase. This matches the profile of an established, income-producing company more than a fast-growth stock, which is common for a dividend-centered holding.

Summary

Booz Allen Hamilton offers a strong case for dividend investors using a quality-centered filter plan. It joins a wanted yield with a lengthy past of dependable and growing payments, all supported by very good profitability that assures longevity. While investors should note its debt-heavy balance sheet, the company’s good cash flow and total financial measures meet the level for an "acceptable" profile wanted by this technique. It shows the kind of stock that can work as a central part of a portfolio built for consistent income.

This review of BAH came from a methodical filter for high-quality dividend payers. If you want to look at other companies that match similar rules for good dividend marks, solid profitability, and adequate financial condition, you can see the full filter findings here.

Disclaimer: This article is for information only and is not financial advice, a suggestion, or an offer to buy or sell any security. Investing has risk, including the possible loss of principal. You should do your own study and talk with a qualified financial advisor before making any investment choices.