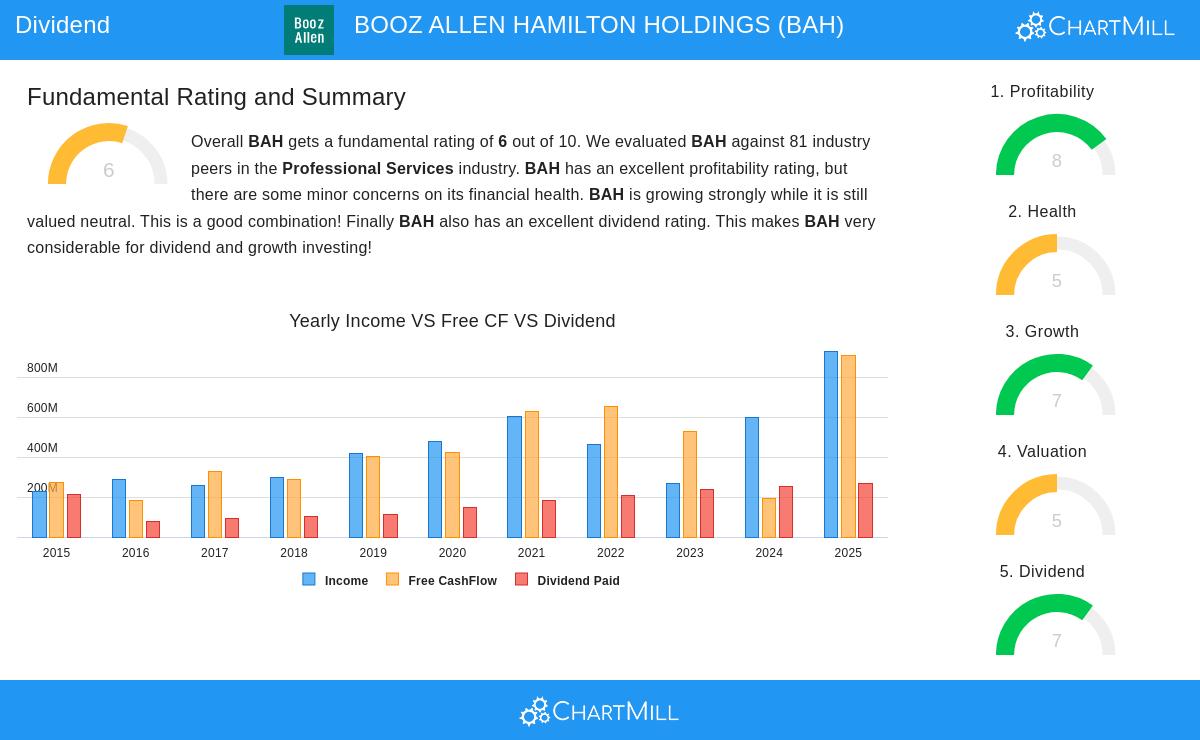

BOOZ ALLEN HAMILTON HOLDINGS (NYSE:BAH) was identified by our Best Dividend Stocks screen, which filters for companies with strong dividend characteristics while maintaining solid profitability and financial health. BAH stands out with a reliable dividend history and reasonable valuation, making it a candidate for income-focused investors.

Dividend Strength

- Dividend Yield: BAH offers a yield of 2.10%, slightly above the industry average of 2.09%. While not the highest, it remains competitive.

- Dividend Growth: The company has increased its dividend at an annualized rate of 14.89% over the past five years, demonstrating a commitment to rewarding shareholders.

- Track Record: BAH has paid dividends for at least 10 years without cuts, indicating reliability.

- Payout Ratio: At 24.48% of earnings, the dividend appears sustainable, with ample room for future increases.

Profitability & Financial Health

- Strong Profitability: BAH scores 8/10 in profitability, with high returns on equity (109.13%) and invested capital (20.59%), outperforming most peers.

- Margins: Operating margins (10.21%) and profit margins (7.34%) are solid and improving.

- Financial Health: While debt levels are elevated (Debt/Equity of 3.90), liquidity metrics like the Current Ratio (1.79) remain healthy.

Valuation & Growth

- Reasonable Valuation: Trading at a P/E of 16.73, BAH is priced below the S&P 500 average (26.25) and cheaper than 63% of its industry peers.

- Earnings Growth: Analysts expect 12.7% annual EPS growth, supporting future dividend increases.

For a deeper look, review the full fundamental report on BAH.

Our Best Dividend Stocks screener provides more high-quality dividend ideas.

Disclaimer

This is not investing advice. Always conduct your own research before making investment decisions.