AUTOZONE INC (NYSE:AZO) stands out as a potential candidate for quality investors, meeting several key criteria from the Caviar Cruise screen. The company demonstrates solid revenue and profit growth, high returns on capital, and efficient cash flow generation—hallmarks of a well-managed business. Below, we examine why AZO fits the quality investing profile.

Key Strengths of AUTOZONE

- Revenue and EBIT Growth: Over the past five years, AZO has delivered consistent revenue growth (5.7% CAGR) and even stronger EBIT growth (11.3% CAGR). This indicates improving operational efficiency and pricing power.

- High Return on Invested Capital (ROIC): With an ROIC of 36.2%, AZO generates substantial returns relative to its invested capital, well above the 15% threshold for quality stocks.

- Strong Profit Quality: The company converts net income into free cash flow at an impressive rate (105% over the past five years), suggesting earnings are backed by real cash generation.

- Manageable Debt: AZO’s debt-to-free cash flow ratio of 4.5 falls within the acceptable range, meaning it could repay its debt in under five years using current cash flows.

Fundamental Analysis Summary

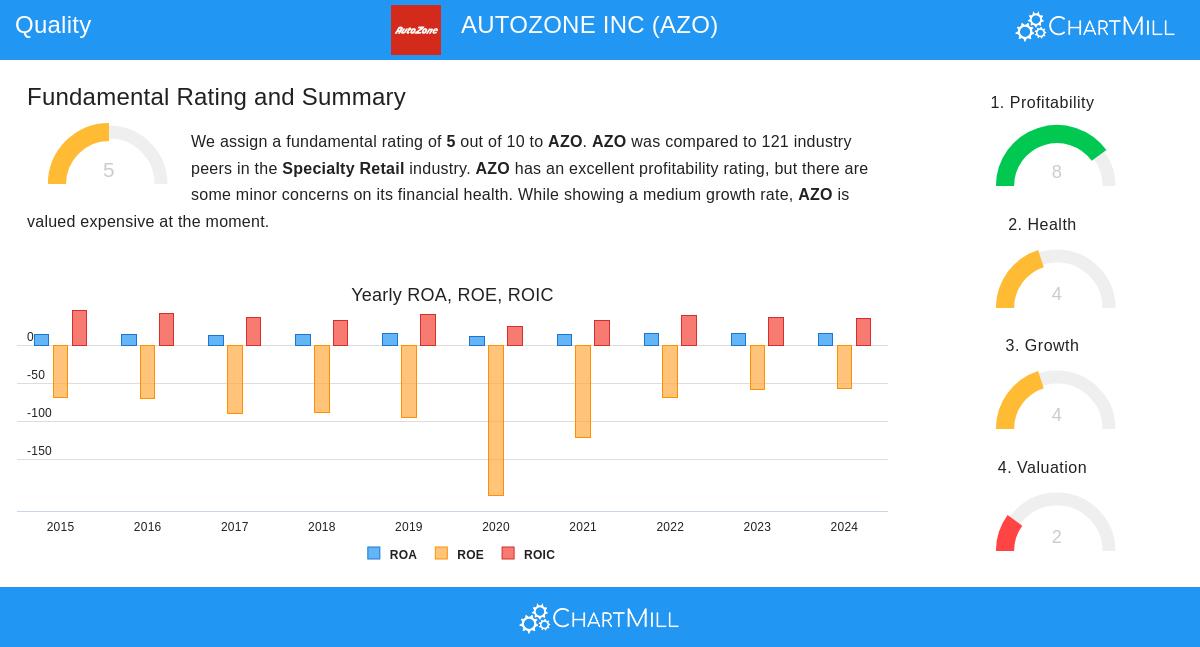

AUTOZONE’s fundamental rating of 5/10 reflects a mixed but generally favorable outlook. The company excels in profitability, ranking near the top of its industry with strong margins (20.1% operating margin, 14.0% net margin). However, liquidity metrics like the current ratio (0.84) raise minor concerns, though its high ROIC and cash flow help offset these risks. Valuation is on the expensive side, with a P/E of 25.7, but this may be justified by its growth and profitability.

For investors seeking quality businesses with durable competitive advantages, AUTOZONE’s consistent performance and efficient capital allocation make it worth further research.

Our Caviar Cruise screener lists more quality stocks and is updated daily.

Disclaimer

This is not investing advice. The observations here are based on data available at the time of writing. Always conduct your own analysis before making investment decisions.