AXON ENTERPRISE INC (NASDAQ:AXON) presents a strong case for investors using a high growth momentum strategy paired with technical breakout analysis. This approach finds companies with outstanding earnings momentum, increasing revenue growth, and positive technical patterns that indicate possible upward price movement. The method mixes fundamental growth measurements with technical study to identify stocks that show both solid business results and positive chart patterns for possible entry points.

Growth Momentum Fundamentals

AXON displays solid growth traits that match high momentum investing standards. The company's financial results show notable increases across several measurements:

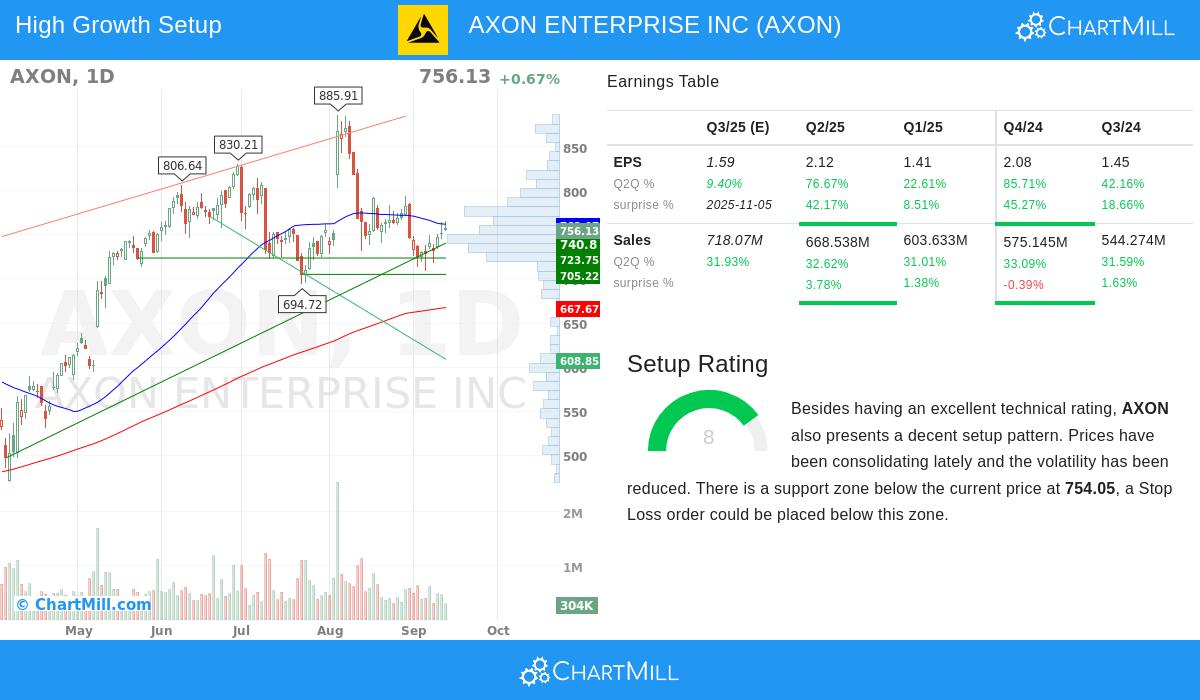

- EPS Growth: 57.2% year-over-year TTM growth, with the latest quarterly results showing 76.7% growth compared to the same quarter last year

- Revenue Expansion: 32.4% year-over-year TTM revenue growth, keeping steady quarterly growth between 31-34% over the previous four quarters

- Free Cash Flow Growth: 59.9% rise in free cash flow per share, showing good operational efficiency and cash creation

- Earnings Surprises: Full history of exceeding EPS estimates in the last four quarters, with an average exceedance of 28.7%

These measurements are especially important for momentum investors as they show not only growth, but increasing growth and steady outperformance versus forecasts. The company's capacity to keep high growth rates while surpassing analyst predictions shows operational quality and market need for its public safety technology products.

Technical Strength and Setup Quality

The technical study shows equally positive traits. According to the detailed technical report, AXON receives a Technical Rating of 8 out of 10, showing good overall technical health. The stock displays:

- Strong Relative Strength: Performing better than 90% of all stocks in the market

- Positive Long-Term Trend: Maintained across different market environments

- Industry Leadership: Positioned in the top group within the Aerospace & Defense sector

The Setup Rating of 8 emphasizes the present consolidation pattern, which technical analysts see positively for possible breakout situations. The stock has been trading in a set range between $708.76 and $794.29 over the last month, now placed in the middle of this range. This consolidation period after earlier upward movement frequently comes before another rise higher, giving a possible entry chance for momentum investors.

Support and Resistance Levels

The technical study finds clear support and resistance areas that give specific risk management parameters:

- Primary Support: Good support zone between $740.21-$754.05 created by several trend lines and moving averages

- Secondary Support: Extra support levels at $723.75-$728.40 and $705.21-$705.22

- Resistance: Important resistance between $756.14-$762.07, which if surpassed could indicate continued upward momentum

These clearly set levels let investors create exact entry and exit points, matching the momentum strategy's focus on risk-managed positions.

Investment Considerations

For high growth momentum investors, AXON represents a strong opportunity because of the meeting of good fundamental growth and positive technical positioning. The company's steady revenue and earnings growth, along with its leading position in the public safety technology market, give the fundamental basis for continued achievement. The present technical setup indicates the stock might be getting ready for its next upward move, possibly offering a positive risk-reward situation.

The mix of these factors—excellent growth measurements, consistent earnings surprises, good relative strength, and a positive technical pattern—makes AXON worth consideration for investors following this method.

For investors wanting to find similar opportunities that meet these strict growth and technical standards, extra screening results are available through our High Growth Momentum Breakout Setups screen. This screen finds companies showing both good growth traits and positive technical patterns for possible breakout situations.

Disclaimer: This analysis is for informational purposes only and should not be considered as investment advice. All investments carry risk, and past performance is not indicative of future results. Investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions.