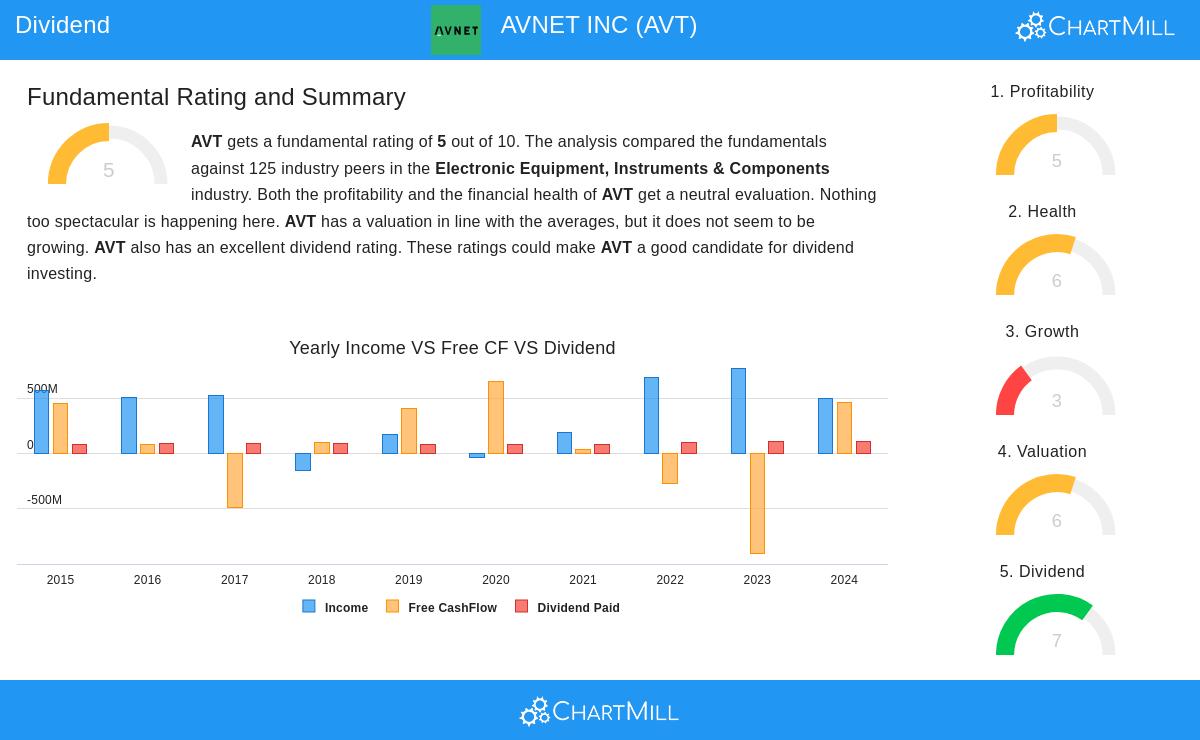

AVNET INC (NASDAQ:AVT) was identified as a strong dividend candidate by our stock screener. The company combines a solid dividend profile with reasonable profitability and financial health, making it an interesting option for income-focused investors.

Dividend Strengths

- Consistent Payouts: AVT has maintained dividend payments for at least 10 years without reductions, demonstrating reliability.

- Growing Dividends: The company has increased its dividend at an annual rate of 9.30%, outpacing many peers.

- Sustainable Payout Ratio: AVT pays out 35.81% of its earnings as dividends, leaving room for reinvestment and future growth.

- Above-Average Yield: With a 2.59% yield, AVT outperforms 96% of its industry peers and aligns with the S&P 500 average.

Profitability & Financial Health

- Stable Margins: AVT’s operating margin (3.04%) and return on equity (6.49%) are competitive within its sector.

- Strong Solvency: The company’s Altman-Z score (3.48) and manageable debt levels indicate low bankruptcy risk.

- Reasonable Valuation: Trading at a P/E of 13.69, AVT is cheaper than 91% of its industry peers.

Considerations

While AVT’s earnings growth has slowed recently, its dividend remains well-supported. Investors should monitor revenue trends, which declined 10.52% year-over-year.

For a deeper analysis, review the full fundamental report on AVNET INC.

Our Best Dividend Stocks screener provides more high-quality dividend ideas, updated daily.

Disclaimer

This is not investment advice. Always conduct your own research before making investment decisions.