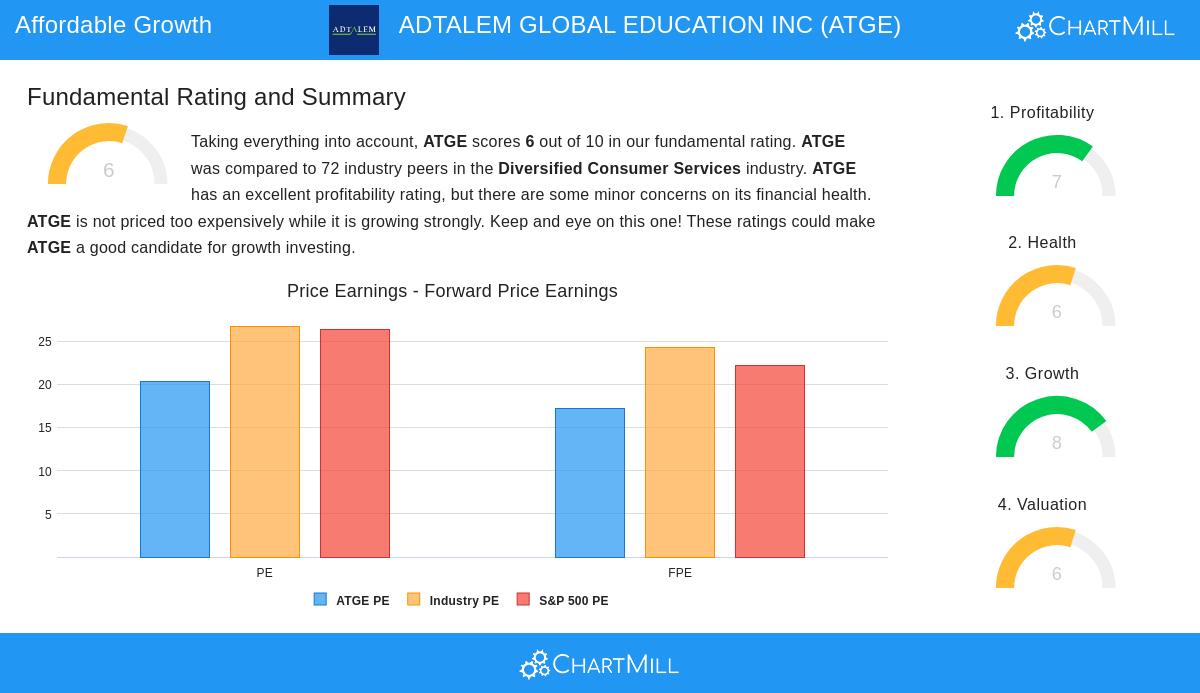

ADTALEM GLOBAL EDUCATION INC (NYSE:ATGE) was identified as an affordable growth stock by our stock screener. The company shows strong growth potential while maintaining reasonable valuation metrics, along with solid profitability and financial health. Below, we examine why ATGE fits the criteria for growth investors seeking value.

Growth Prospects

ATGE demonstrates strong historical and expected future growth:

- Earnings Per Share (EPS) grew 36.25% in the past year, with a 5-year average annual growth of 12.11%.

- Revenue increased 13.10% year-over-year, with a long-term average growth of 9.34%.

- Analysts project EPS growth of 20.13% annually in the coming years, indicating accelerating profitability.

Valuation

Despite its growth, ATGE remains reasonably priced:

- The P/E ratio of 20.30 is below the industry average, making it cheaper than 70.83% of peers.

- Its forward P/E of 17.25 is also lower than the S&P 500 average of 22.20.

- The PEG ratio, which accounts for growth, suggests the stock is undervalued relative to its earnings potential.

Profitability & Financial Health

- Profitability (7/10 rating): ATGE has strong margins, with a 19.55% operating margin outperforming 86.11% of industry peers.

- Financial Health (6/10 rating): The company has a solid Altman-Z score of 4.41, indicating low bankruptcy risk. However, its current ratio of 0.83 raises minor liquidity concerns.

For a deeper look, review the full fundamental analysis report for ATGE.

Our Affordable Growth screener lists more stocks with similar characteristics and is updated daily.

Disclaimer

This is not investing advice! The article highlights observations at the time of writing, but you should conduct your own research before making investment decisions.