AMPHENOL CORP-CL A (NYSE:APH) has been identified as a high-growth momentum stock that aligns with Mark Minervini’s Trend Template. The company, a leading manufacturer of electronic connectors and sensors, demonstrates strong technical and fundamental characteristics that make it a compelling candidate for growth-focused investors.

Why APH Fits the Minervini Trend Template

Minervini’s strategy focuses on stocks exhibiting strong uptrends, supported by key technical criteria. APH meets these requirements:

-

Price Above Key Moving Averages:

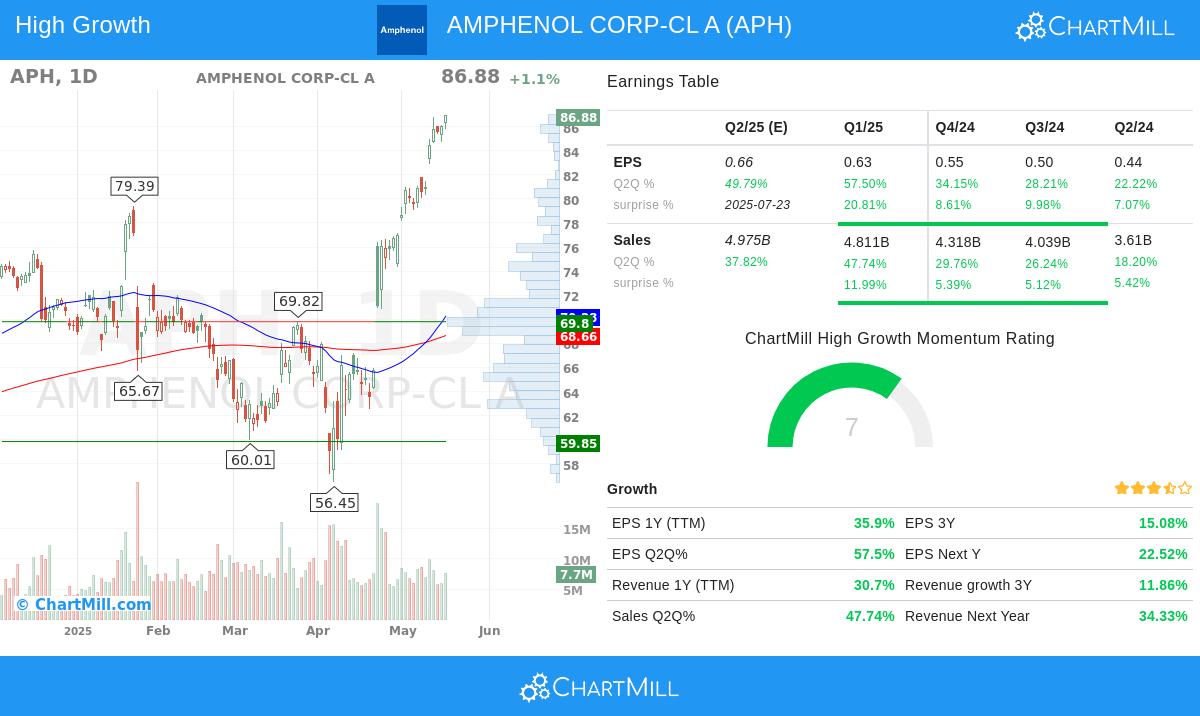

- Current price ($86.88) is well above the 50-day ($70.28), 150-day ($70.25), and 200-day ($68.66) moving averages.

- The 50-day MA is above both the 150-day and 200-day MAs, confirming bullish momentum.

-

Upward-Trending Averages:

- The 150-day and 200-day MAs are rising, reinforcing long-term strength.

-

Price Relative to 52-Week Range:

- APH is trading within 0.1% of its 52-week high ($86.96) and 58.7% above its 52-week low ($54.77).

-

Strong Relative Strength:

- With a ChartMill Relative Strength (CRS) score of 93.14, APH outperforms 93% of all stocks.

High Growth Momentum Fundamentals

Beyond technical strength, APH shows robust growth metrics:

-

Earnings Growth:

- EPS grew 35.9% YoY (TTM) and 57.5% in the most recent quarter.

- Quarterly EPS has consistently beaten estimates, with an average beat of 11.6% over the last four quarters.

-

Revenue Expansion:

- Sales surged 47.7% in the latest quarter, with full-year revenue up 21.3%.

- Revenue estimates for the next quarter and year have been revised upward by analysts.

-

Profitability:

- Profit margins remain healthy at 15.3% (latest quarter), with consistent improvements over previous periods.

Technical Outlook

According to ChartMill’s technical report, APH scores a perfect 10/10 for technical health, supported by:

- Strong short- and long-term uptrends.

- Recent breakout to new 52-week highs.

- High liquidity with average daily volume of 8.84M shares.

While the stock’s recent volatility suggests waiting for a consolidation before entry, its overall trend and growth profile make it a standout candidate for momentum investors.

For a deeper analysis, review the full technical report on APH.

Our High Growth Momentum + Trend Template screener lists more stocks with similar growth and trend characteristics.

Disclaimer

This is not investment advice. Conduct your own research and consider risk tolerance before making investment decisions.