ADOBE INC (NASDAQ:ADBE) was identified as a decent value stock by our screener, which looks for companies with solid fundamentals and reasonable valuations. ADBE stands out with strong profitability, healthy financials, and steady growth, all while trading at a valuation that may appeal to value investors.

Valuation

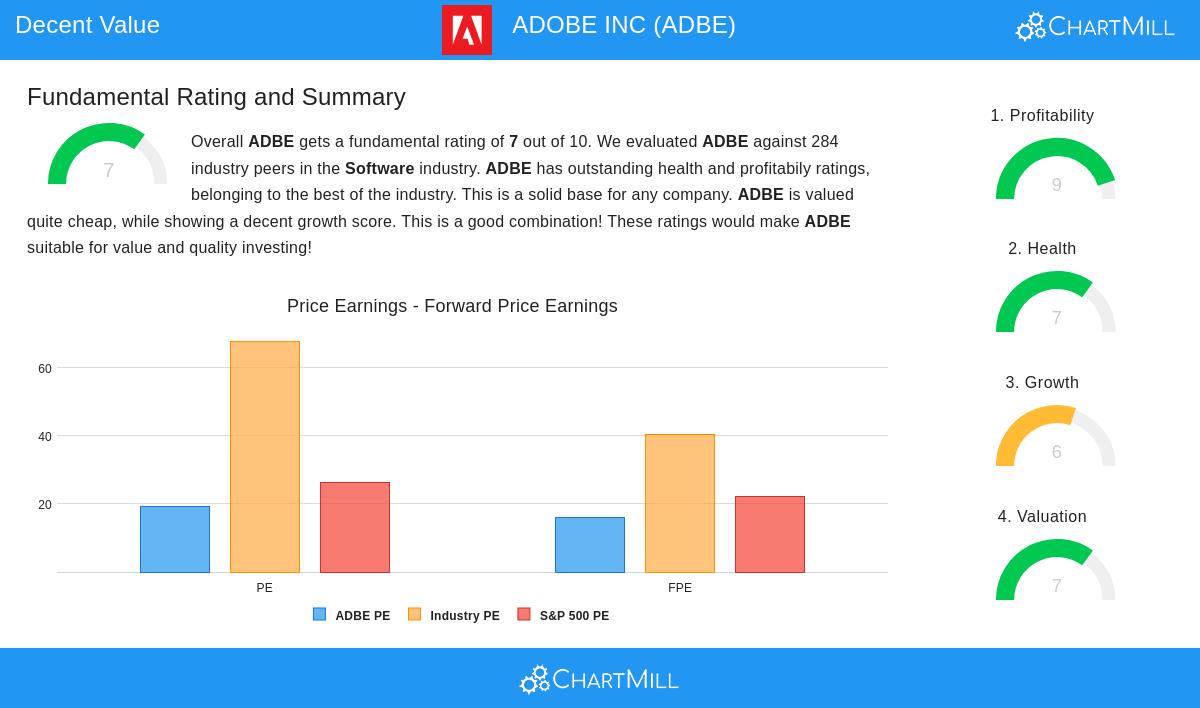

ADBE’s valuation metrics suggest the stock may be attractively priced relative to its industry peers:

- P/E Ratio: At 19.29, it is cheaper than 80.63% of software industry stocks.

- Forward P/E: 15.98, below both the industry average (40.35) and the S&P 500 (22.19).

- Price/Free Cash Flow: More favorable than 85.92% of competitors.

- Enterprise Value/EBITDA: Lower than 82.04% of peers.

Despite strong profitability, ADBE trades at a discount compared to many high-growth software firms.

Profitability

ADBE excels in profitability, with industry-leading margins:

- Gross Margin: 89.25%, outperforming 96.83% of peers.

- Operating Margin: 36.37%, ranking in the top 3.5% of the sector.

- Return on Equity (ROE): 60.00%, better than 97.18% of competitors.

- Return on Invested Capital (ROIC): 34.50%, exceeding 97.54% of the industry.

These metrics highlight ADBE’s ability to efficiently convert revenue into earnings.

Financial Health

ADBE maintains a stable financial position:

- Altman-Z Score: 9.65, indicating low bankruptcy risk.

- Debt/FCF Ratio: 0.65, meaning it could repay debt in under a year.

- Debt/Equity: 0.54, manageable but slightly higher than some peers.

While liquidity ratios (Current and Quick Ratios) are below industry averages, strong cash flow and solvency mitigate concerns.

Growth

ADBE has demonstrated consistent growth:

- Revenue Growth (5-year CAGR): 14.00%.

- EPS Growth (5-year CAGR): 18.69%.

- Expected Future EPS Growth: 11.51%, still robust despite a slight slowdown.

The company’s shift toward AI-driven tools (like Adobe Firefly and GenStudio) could sustain future expansion.

For a deeper analysis, review the full fundamental report on ADBE.

Our Decent Value Stocks screener lists more stocks with strong valuations and fundamentals.

Disclaimer

This is not investing advice! The article highlights observations at the time of writing, but you should conduct your own research before making investment decisions.