The investment philosophy of Peter Lynch, the legendary manager of the Fidelity Magellan Fund, has long been a cornerstone for investors seeking to build wealth over the long term. His approach, often categorized as Growth at a Reasonable Price (GARP), focuses on identifying companies with strong, sustainable growth potential that are not overvalued by the market. It is a strategy that prioritizes fundamental health and understandable business models over speculative trends, advocating for patience and deep research. By applying a filter based on Lynch's key criteria, investors can create a shortlist of companies worthy of further investigation, seeking those that combine solid profitability, financial stability, and an appealing valuation relative to their growth path.

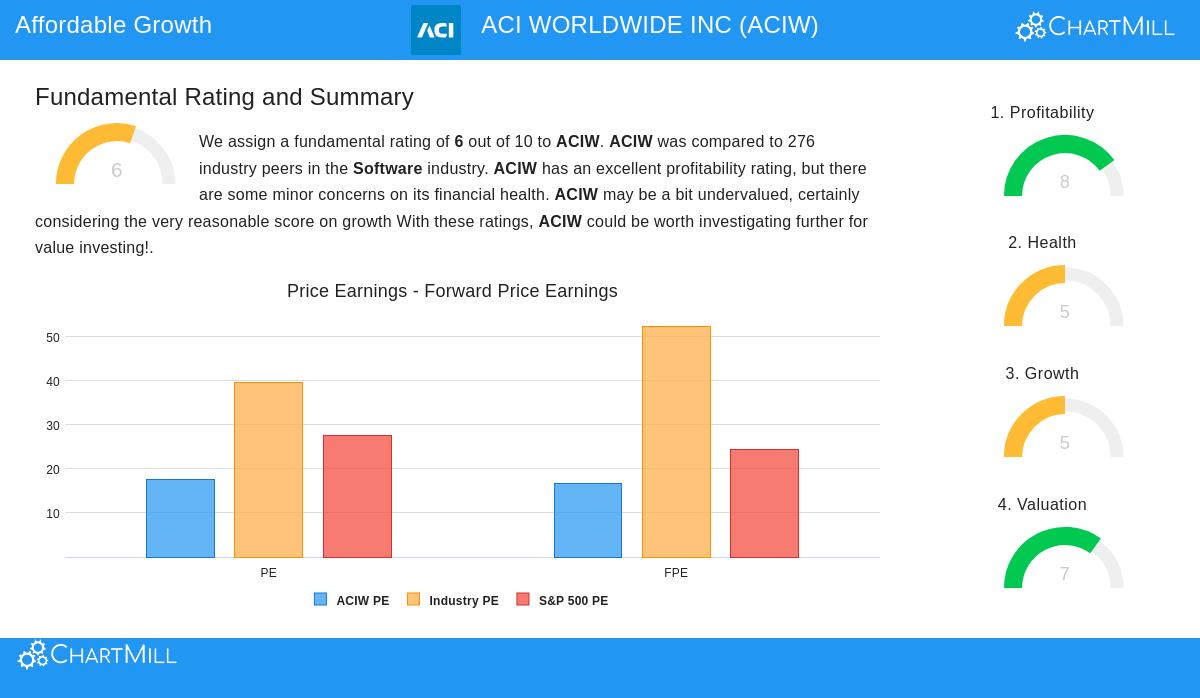

One company that appears from a Peter Lynch-style filter is ACI Worldwide Inc. (NASDAQ:ACIW), a provider of real-time electronic payment software and solutions. For investors aligned with the GARP philosophy, ACIW presents a noteworthy case for review based on the specific metrics Lynch highlighted.

Alignment with Peter Lynch Criteria

Lynch's strategy avoids extreme growth in favor of sustainable expansion, and values financial prudence and profitability. ACIW's fundamentals match closely with several of his prescribed filters.

- Sustainable Earnings Growth: Lynch favored companies with a proven record of earnings growth, but was cautious of unsustainably high rates. The filter calls for a 5-year EPS growth between 15% and 30%. ACIW's EPS has increased at an average annual rate of 27.5% over this period, sitting within the upper part of Lynch's target range, indicating steady and controlled expansion.

- Reasonable Valuation (PEG Ratio): Perhaps the central part of the GARP approach, the Price/Earnings to Growth (PEG) ratio helps determine if a stock's price is justified by its growth rate. Lynch sought a PEG of 1 or less. ACIW's PEG ratio, based on its past five-year growth, is about 0.64. This indicates the market may be pricing the company's historical growth performance below its value, a key signal for value-conscious growth investors.

- Strong Profitability (ROE): Return on Equity (ROE) measures how efficiently a company generates profits from shareholder equity. Lynch looked for a minimum of 15%. ACIW's ROE of 17.6% meets this level and also ranks well within its software industry peer group, indicating effective management and a lasting competitive advantage.

- Financial Health (Debt & Liquidity): A conservative balance sheet was important to Lynch. He preferred a Debt-to-Equity ratio below 0.6. ACIW's ratio of 0.56 indicates a balanced use of debt and equity financing. Also, its Current Ratio of 1.58 exceeds Lynch's minimum of 1, showing a good ability to cover short-term obligations, which adds to overall financial strength.

Fundamental Health Overview

A wider look at ACI Worldwide's fundamental profile supports the picture shown by the Lynch filter. The company gets a good overall rating, with specific strengths in profitability. Its profit and operating margins are solid and have shown gains, while returns on assets, equity, and invested capital all perform better than many industry competitors. This steady profitability is a characteristic of the type of company Lynch advised investors to hold for the long term.

On valuation, the analysis presents a mixed but finally positive view for a GARP investor. While its standard P/E ratio might seem high alone, it is actually lower than most of its software industry peers and the wider S&P 500. More significantly, metrics that include growth and cash flow, such as the PEG, Price/Free Cash Flow, and Enterprise Value/EBITDA ratios, all suggest a relatively low valuation within its sector. The main point of caution is in the financial health category, where the analysis notes a rising debt-to-assets ratio, though the company's overall solvency, as shown by a good Altman-Z score, stays firm.

For a detailed breakdown of these fundamental factors, you can review the full Fundamental Analysis Report for ACIW.

Investment Thesis for the GARP Investor

For an investor following Peter Lynch's principles, ACI Worldwide represents a possible candidate that meets many critical points. The company works in the essential and growing field of electronic payments, a simple but important sector that fits Lynch's preference for understandable businesses. Its historical growth is good but not excessive, and it is available at a price that seems to account for that growth fairly, as shown by the sub-1 PEG ratio. The strong ROE and sufficient liquidity suggest a well-managed firm able to maintain itself.

The Lynch strategy is not about following short-term momentum but about finding lasting companies for a long-term portfolio. ACIW's profile, marked by profitable growth, acceptable debt, and a good valuation relative to its historical performance, makes it a stock that justifies deeper research for investors with that perspective. It shows the search for quality growth without paying a high premium.

Interested in reviewing other companies that fit this disciplined investment approach? You can run the filter yourself and see the current results via the Peter Lynch Strategy Stock Screener.

Disclaimer: This article is for informational and educational purposes only and does not constitute investment advice, financial advice, or a recommendation to buy or sell any security. The analysis is based on publicly available data and a specific investment strategy framework. Investors should conduct their own thorough research and consider their individual financial circumstances and risk tolerance before making any investment decisions.