For investors looking for chances where a company's market price may not show its full business condition, a systematic filtering method can be a good first step. One way is to find stocks that join an attractive price with good basic condition, earnings ability, and growth outlook. This process tries to find companies that are not just low-priced, but are selling for less compared to their operational quality and financial steadiness, a central idea of value investing. By using filters for high price scores together with acceptable scores in other important areas, investors can sort through the market for possible choices that present a good balance of risk and reward.

One company that appears from this "acceptable value" filter is ACI Worldwide Inc (NASDAQ:ACIW). The company offers important software and systems for instant digital payments, helping banks, retailers, and billing organizations worldwide. A detailed look at its basic report shows why it could deserve more attention from investors concentrated on inherent worth.

Price: An Attractive Starting Level

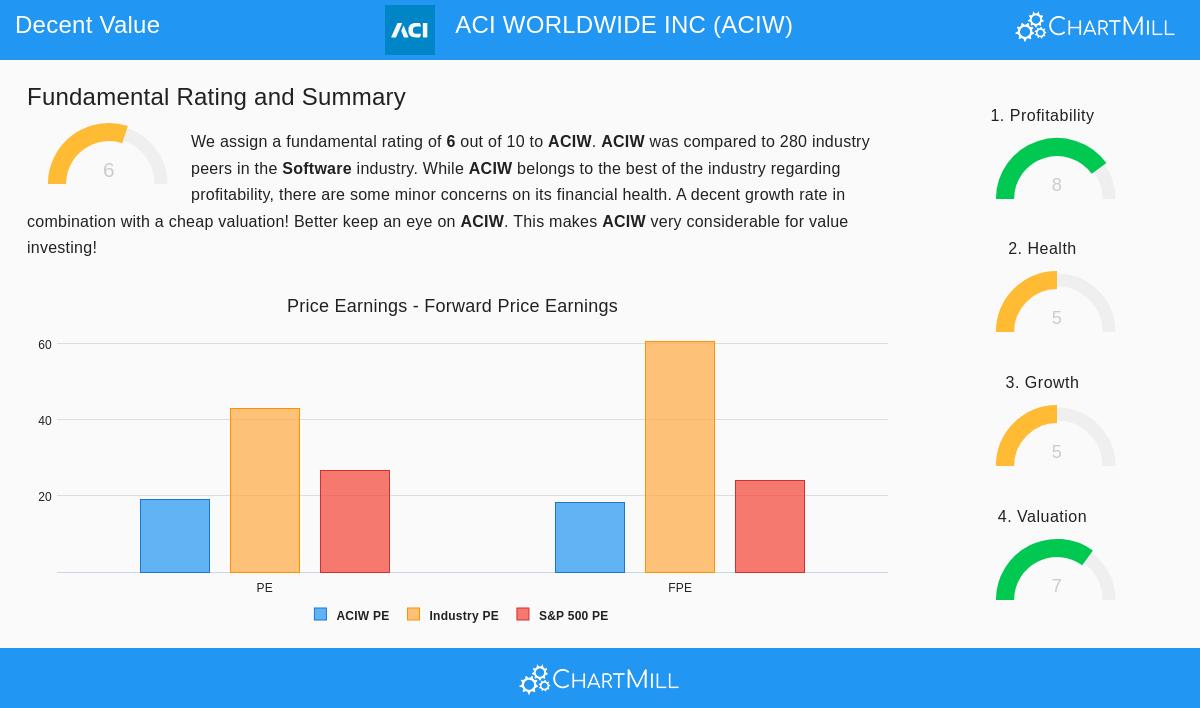

The main draw for a value-focused filter is a stock's price score, and ACI Worldwide does good here with a score of 7 out of 10. This score implies the stock is priced well compared to both its industry and its own future possibility. Important measures backing this view are:

- Price-to-Earnings: With a P/E ratio of 19.14, ACIW is priced lower than almost 77% of its software industry equals and is under the wider S&P 500 average.

- Cash Flow & EBITDA: The price seems even more attractive when checking cash creation. The company's Price-to-Free Cash Flow and Enterprise Value-to-EBITDA ratios are lower than about 84% and 86% of industry rivals, in order.

- Growth Consideration: The forward P/E ratio and a low PEG ratio, which includes earnings growth, suggest the market may not be completely valuing the company's projected profit increase.

For a value investor, these measures are key. They help spot a possible difference between the company's market price and its inherent worth, giving that needed "buffer" where the price paid is notably lower than the calculated value of the business.

Earnings Ability: Showing Operational Quality

A low price by itself can be a problem if the basic business is poor. Luckily, ACI Worldwide's most solid basic part is its earnings ability, which gets a high score of 8. The company shows a capacity to effectively turn sales into profits.

- Good Returns: The company has good returns on assets (8.25%), equity (17.64%), and invested capital (12.16%), each doing better than a big majority of its software industry equals.

- Good and Improving Margins: Both its Profit Margin (15.07%) and Operating Margin (20.83%) are much higher than industry averages and have shown upward movements in recent years.

This steady earnings ability is a key filter for value methods. It points to a business with a lasting market edge and skilled leadership, things that support the idea that current profits and cash flows can continue, making a low price relative to them more significant.

Financial Condition: A Mostly Steady Base

Financial condition, with a score of 5, shows a more varied but generally steady view. Solvency measures are sufficient, though there are points to watch.

- Good Indicators: The company has a sound Altman-Z score (3.61), showing low short-term failure risk, and a fair Debt-to-Free Cash Flow ratio of 3.02, meaning it could reduce debt from cash flow in a practical period. The decrease in shares available over the past year and five years is also a decision that benefits shareholders.

- Points to Watch: The report mentions that the debt-to-assets ratio has gone up compared to a year ago, and the Debt-to-Equity ratio is higher than many industry equals. While not at worrying levels, this needs watching to make sure financial room stays good.

A reasonable financial condition score is essential for careful value investing. It makes sure the company can handle economic slowdowns, put money into its business, and avoid trouble that could lower shareholder value, guarding the investor's buffer from unexpected balance sheet dangers.

Growth: A History with a Future Direction

With a growth score of 5, ACI Worldwide displays a believable, though not rapid, growth picture that fits with its value argument.

- Previous Results: The company has achieved very good growth in Earnings Per Share (EPS) over recent years, averaging 27.49% each year, with a 17.54% rise over the past year.

- Future Predictions: Experts forecast continued EPS growth at a solid rate of about 15.13% each year over the next few years, along with steady sales growth.

For a value investment to succeed, the business cannot be in constant drop. The existence of both a strong past growth trend in profits and sensible forward estimates helps reduce the danger of a "value problem," where a low price is reasonable because of worsening outlooks. It suggests the company is increasing its inherent worth over time.

Summary

ACI Worldwide Inc. presents an example in how filtering for "acceptable value" can point out interesting possibilities. It is not a company without details, its financial borrowing needs observation and its sales growth is stable instead of amazing. However, its main investment idea is attractive: it seems to be an earnings-strong, growing business in the necessary payments technology field, trading at price levels that are reduced relative to both its industry and its own earnings capacity. This mix of operational quality and good price is exactly what value-focused filters are made to find.

Find Other Possible Value Choices This review of ACI Worldwide came from a particular basic filtering method. If you want to examine other stocks that fit similar standards of good price along with acceptable earnings ability, condition, and growth, you can check the filter settings and outcomes yourself here.

Notice: This article is for information only and does not make financial guidance, a suggestion, or a plan to buy or sell any security. The review is based on data and scores from ChartMill, and investors should do their own research and talk with a registered financial advisor before making any investment choices. Past results do not show future outcomes.