When looking for reliable dividend-paying stocks, investors often use screening methods that balance income generation with financial stability. A common method involves finding companies with good dividend traits while keeping solid profitability and healthy balance sheets. This strategy helps avoid high-yield situations where unsustainable payments hide basic business problems. By concentrating on stocks that rate well across several basic areas, investors can create a portfolio made for steady income with lower risk.

Dividend Profile and Sustainability

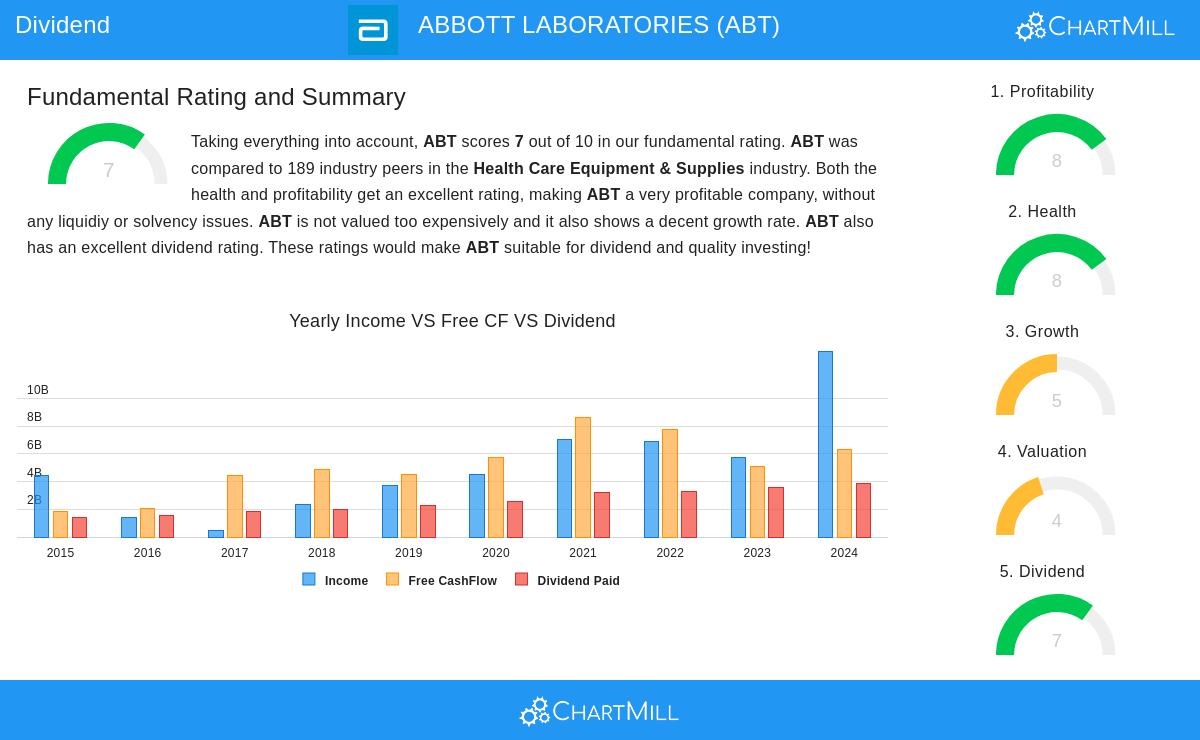

ABBOTT LABORATORIES (NYSE:ABT) presents a strong case for dividend investors looking for both reliability and growth. The company's dividend traits show why it is notable in screening that focuses on lasting income generation.

- Current dividend yield of 1.87%, doing better than 95.77% of industry peers

- Steady yearly dividend growth averaging 11.40% over recent years

- Kept dividend payments for over ten years without decreases

- Manageable payout ratio of 28.42% of income

The reasonable yield paired with good dividend growth shows a balanced method for shareholder returns. This pairing is especially useful for long-term investors, as increasing dividends can meaningfully improve total returns over time. The low payout ratio gives a good buffer for keeping payments during economic slowdowns, meeting a main worry for income-focused investors who value payment reliability more than highest current yield.

Profitability Foundation

Good profitability forms the base for lasting dividend payments, and Abbott Laboratories does well in this area. The company's earnings ability makes sure it can keep and raise distributions without stressing financial resources.

- High return numbers including 27.65% return on equity and 16.64% return on assets

- Good profit margin of 32.43%, placed in the top group of the healthcare equipment industry

- Steady profitability over the last five years with positive operating cash flow

- Operating margin of 17.97% showing efficient operations

These profitability numbers point to a business with lasting competitive benefits and efficient capital use. For dividend investors, this operational good health means lower chance of dividend reductions during economic stress. The company's ability to create good returns on invested capital suggests it can keep funding both business growth and shareholder returns at the same time.

Financial Health Evaluation

A company's financial health directly affects its ability to keep dividend payments through different market situations. Abbott Laboratories shows good financial standing that supports continued dividend reliability.

- Strong solvency with debt-to-equity ratio of 0.26 showing little debt use

- High Altman-Z score of 5.74 indicating low bankruptcy chance

- Debt-to-free-cash-flow ratio of 1.98 giving high repayment ability

- Better debt management with lower debt-to-assets ratio than the year before

The company's balance sheet good health gives multiple layers of safety for dividend investors. Low debt lowers weakness to interest rate hikes or credit market problems, while good cash flow creation ensures the company can easily handle its duties while keeping shareholder payments. This financial strength is especially important for income investors who value payment steadiness over highest yield.

Growth Path and Valuation

While current income is important for dividend investors, future growth possibilities decide a company's ability to raise distributions over time. Abbott Laboratories shows positive growth patterns that support continued dividend growth.

- Expected earnings per share growth of 9.87% each year based on analyst estimates

- Revenue growth speed increase projected at 7.13% in coming years

- Current valuation similar to S&P 500 averages even with better profitability

- Price-to-earnings ratio of 25.42 compared to industry average of 26.02

The company's growth view suggests it can keep raising dividends without hurting financial health. For dividend growth investors, this mix of current income and future growth possibility makes an appealing total return profile. The fair valuation next to growth prospects gives some safety margin, an important point given the high valuations often seen with good quality dividend payers.

Full Basic Evaluation

The detailed basic analysis report gives more understanding into Abbott Laboratories' investment traits across several areas. The company's overall basic rating of 7 out of 10 shows its balanced profile of good dividend traits, high profitability, and sound financial health. This full evaluation matches well with dividend investment plans that look for companies able to keep and grow payments through different market situations.

For investors looking for similar chances, the Best Dividend Stocks screen gives a systematic method for finding companies with good dividend traits along with healthy profitability and financial numbers. This method helps investors avoid the common mistake of following high yields without thinking about the basic business factors that support those payments.

Disclaimer: This analysis is based on current basic data and does not form investment advice. Investors should do their own research and think about their personal financial situation before making investment choices. Past performance does not ensure future results, and dividend payments depend on company choice and different market situations.