Lynch preferred companies with low P/E ratios relative to growth, manageable debt, and strong profitability. In this analysis, we see if SCHLUMBERGER LTD (NYSE:SLB) fits his winning formula.

Following Peter Lynch’s approach: Does SCHLUMBERGER LTD (NYSE:SLB) fit the bill?

- SLB exhibits a strong Return on Equity (ROE) of 21.11%, indicating the company's ability to generate solid returns on shareholder investments. This metric reflects the company's efficient utilization of equity capital and its profitability.

- At a Debt/Equity ratio of 0.52, SLB seems well-positioned to sustain growth while keeping debt in check.

- The EPS of SLB has shown consistent growth over a 5-year period, indicating the company's ability to generate increasing earnings over time.

- With a PEG ratio of 0.55, SLB appears to be fairly valued given its strong growth prospects.

- SLB maintains a healthy liquidity position with a Current Ratio of 1.45.

What is the full fundamental picture of SLB telling us.

As part of its analysis, ChartMill provides a comprehensive Fundamental Rating for each stock. This rating, ranging from 0 to 10, is updated on a daily basis and is based on the evaluation of various fundamental indicators and properties.

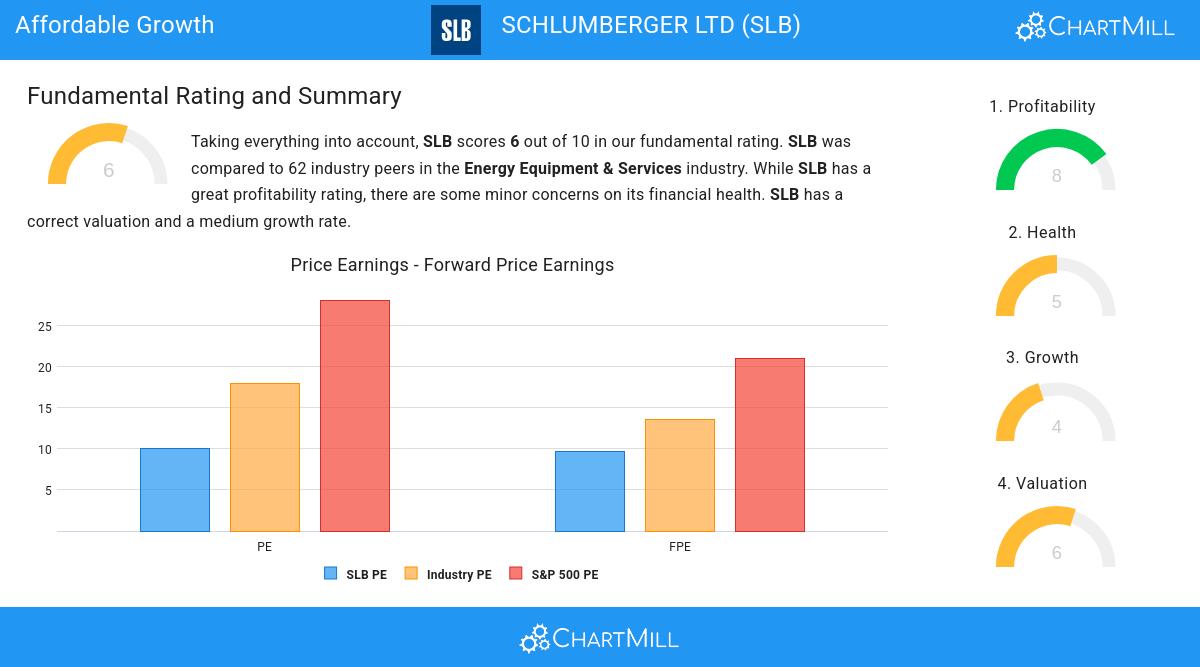

SLB gets a fundamental rating of 6 out of 10. The analysis compared the fundamentals against 62 industry peers in the Energy Equipment & Services industry. While SLB belongs to the best of the industry regarding profitability, there are some minor concerns on its financial health. SLB is not valued too expensively and it also shows a decent growth rate.

For an up to date full fundamental analysis you can check the fundamental report of SLB

Our Peter Lynch screener lists more Affordable Growth stocks and is updated daily.

Disclaimer

This is not investing advice! The article highlights some of the observations at the time of writing, but you should always make your own analysis and invest based on your own insights.