Qifu Technology Inc (NASDAQ:QFIN) stands out as an undervalued stock with solid financial health and profitability. The company, operating in China’s consumer finance sector, provides credit technology services and has demonstrated consistent growth. Our fundamental analysis suggests QFIN is attractively priced relative to its earnings potential and industry peers.

Key Strengths

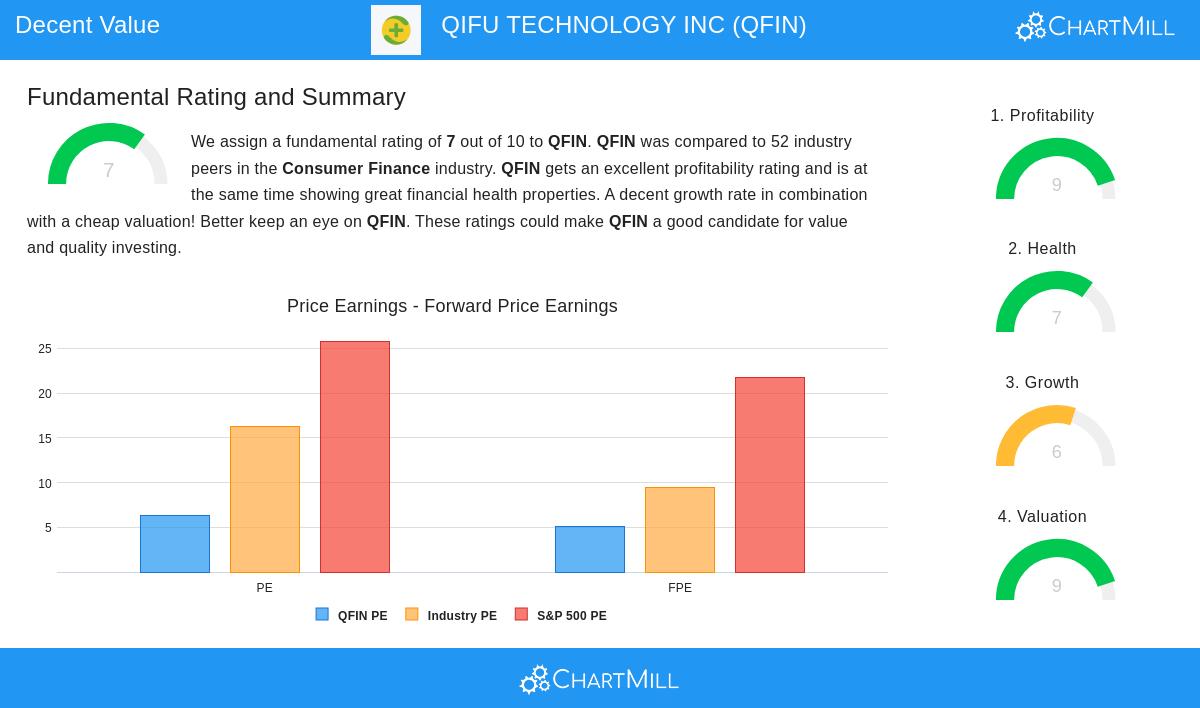

Valuation (Score: 9/10)

- QFIN trades at a P/E ratio of 6.29, significantly below the industry average (16.24) and the S&P 500 (25.82).

- Its forward P/E of 5.07 suggests further upside potential.

- The stock is cheaper than 84.6% of its peers based on Enterprise Value/EBITDA.

Profitability (Score: 9/10)

- Exceptional Profit Margin (38.98%), outperforming 98% of the industry.

- Strong Return on Equity (29.92%) and Return on Invested Capital (16.09%), ranking in the top 10% of its sector.

- Operating Margin of 45.98% highlights efficient cost management.

Financial Health (Score: 7/10)

- Low Debt/Equity ratio (0.27), better than 82.7% of competitors.

- Healthy liquidity with a Current Ratio of 3.08, indicating no short-term solvency risks.

- Positive free cash flow supports dividend sustainability.

Growth (Score: 6/10)

- EPS grew 68.6% over the past year, with a 5-year annualized growth of 19.96%.

- Revenue growth remains steady at 13.24% (5-year average).

- Analysts expect 16.2% annual EPS growth in the coming years.

Why QFIN Fits Value Investing Criteria

QFIN’s low valuation, strong profitability, and manageable debt make it a candidate for value investors. The company’s ability to generate high returns on capital while trading at a discount to peers suggests potential upside.

For a deeper dive, review the full fundamental analysis of QFIN.

Our Decent Value Stocks screener lists more stocks with similar characteristics.

Disclaimer

This is not investment advice. Always conduct your own research before making financial decisions.