Technical analysis investors often look for stocks displaying both good momentum and consolidation patterns that indicate possible breakout chances. One methodical process uses filters for securities with high technical ratings, which assess general trend condition, paired with high setup quality scores that find times of price consolidation. This system helps find stocks that keep good technical condition while providing acceptable risk-reward entry points as they leave trading ranges.

Technical Strength Assessment

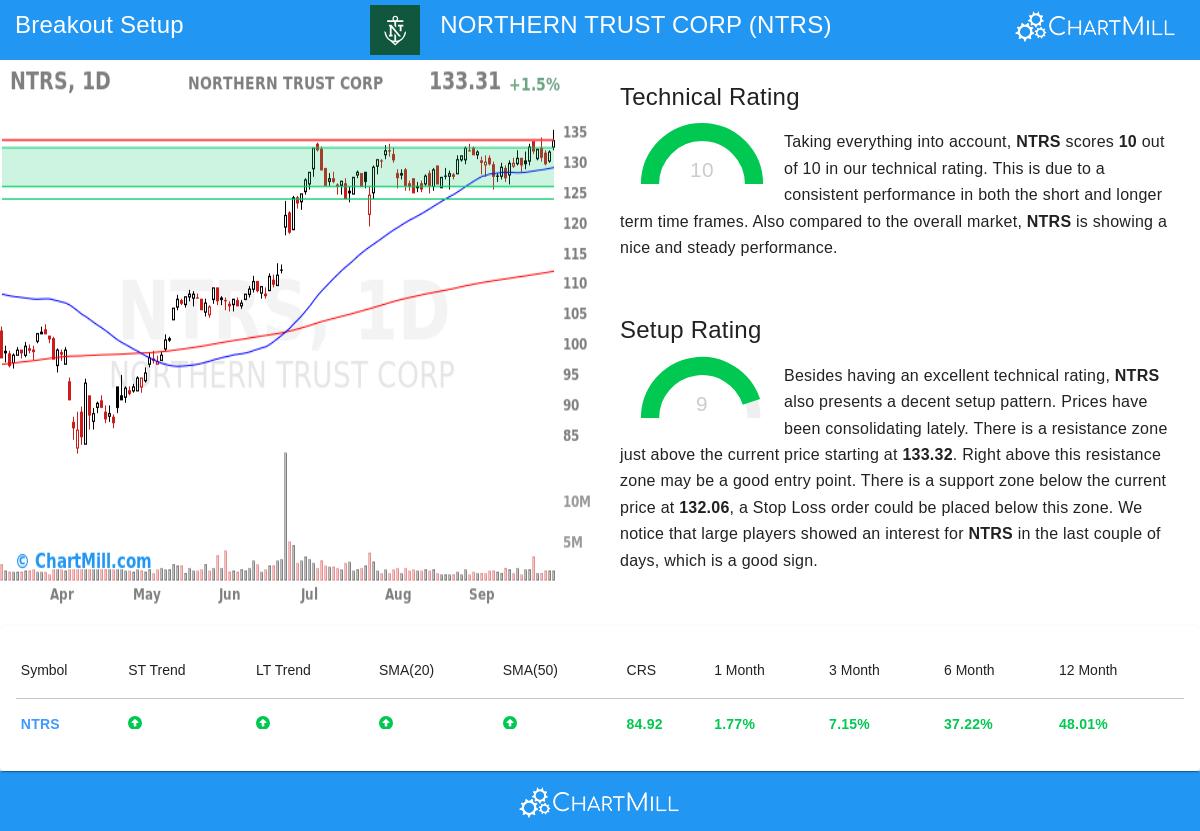

Northern Trust Corp (NASDAQ:NTRS) shows very good technical qualities according to the ChartMill Technical Analysis report, getting a top rating of 10 out of 10. This highest score shows the stock's steady results across different time periods and technical measures. The technical rating checks several important items that match the breakout screening method's focus on finding stocks with confirmed upward momentum.

Important technical qualities supporting this rating are:

- Both short-term and long-term trends are clearly positive, showing continued buying interest

- The stock displays good relative condition, doing better than 84% of all stocks over the last year

- In the Capital Markets industry, NTRS does better than 84% of 237 similar companies

- All main moving averages (20, 50, 100, and 200-day) are increasing and placed below the present price

- Recent trading close to 52-week highs confirms the stock's good momentum features

These technical features are important for breakout methods because stocks with confirmed upward trends and good relative condition often keep their momentum after successful breakouts from consolidation patterns.

Setup Quality Evaluation

Northern Trust shows an interesting setup pattern with a setup quality rating of 9 out of 10, suggesting the stock is in a notable price consolidation. This high setup score indicates the stock has been moving within a set range lately, building possibility for a clear breakout move. The setup quality measure is necessary for finding good entry points, as it helps prevent buying after large moves while getting ready for the next possible upward move.

The present technical setup shows:

- A clear resistance area starting at $133.32, made by several trendlines

- Good support between $125.64 and $132.06, formed by different moving averages and trendlines

- Recent movement within the $125.25 to $135.00 range during the last month

- Signs of institutional buying based on Effective Volume study

- Present price activity close to the top edge of the recent trading range

For breakout traders, this consolidation pattern gives clear levels for possible entry above resistance and protective stop-loss placement below support areas, forming a structured risk management plan.

Trading Considerations

The mix of very good technical condition and high-quality setup makes Northern Trust a possibility for technical breakout methods. The stock's location near multi-year highs with set support and resistance levels gives a measurable risk-reward situation. The proposed trading method involves possible entry above the $133.32 resistance level with downside protection below the support area.

Traders should know:

- The stock keeps above-average trading volume, providing sufficient liquidity

- The present price is about 3.9% below the proposed entry point

- A breakout above resistance might indicate the next upward move in the confirmed trend

- The 52-week result of 48% shows the stock's ability for continued growth

Finding Other Possibilities

The Technical Breakout Setups screen that found Northern Trust is refreshed each day with new possible chances. Investors can access the present screening results to see other stocks showing similar technical condition and setup quality features.

Disclaimer: This analysis is based on technical indicators and historical price patterns and should not be considered as investment advice. Always conduct your own research, consider your risk tolerance, and consult with a financial advisor before making investment decisions. Past performance does not guarantee future results, and all trading involves risk including the potential loss of principal.