For investors looking to join solid fundamental growth with well-timed technical entry points, a multi-factor screening method can be an effective instrument. By selecting for stocks that show firm earnings momentum, favorable analyst revisions, and quickening sales, collectively measured in ChartMill's High Growth Momentum (HGM) Rating, and then adding that with strict technical health (TA Rating) and setup quality (Setup Rating), one can find companies that are not only expanding quickly but are also set for a possible price advance. This process tries to seize the core of growth investing inside an organized technical structure, looking for chances where fundamental force meets a constructive chart formation.

ERO COPPER CORP (NYSE:ERO) appears from such a filter, presenting a noteworthy case for high-growth momentum investors who also value technical timing. The Brazilian-focused copper and gold miner displays the sort of forceful fundamental quickening the HGM rating is made to emphasize, while its chart indicates the stock is pausing before a possible new phase upward.

Fundamental Growth Momentum

The heart of the high-growth momentum plan is finding companies with quickening business trends, and Ero Copper's latest operational and financial results give a firm base. Its HGM Rating of 6 shows firm grades across several important growth and momentum measures needed for this plan.

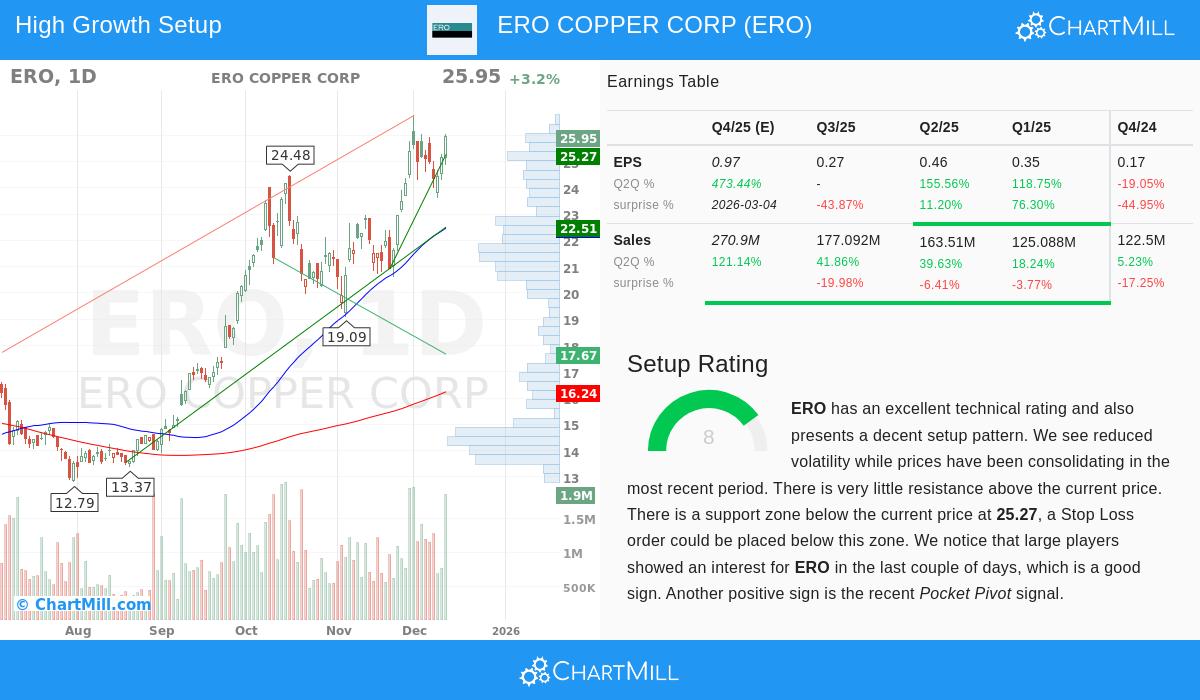

- Sales Quickening: The company is displaying a clear trend of quickening revenue growth on a quarter-over-quarter basis. Recent sales growth numbers have risen in order from 5.26% to 18.24%, 39.64%, and most lately to 41.86% compared to the same quarters a year earlier. This steady quickening is a main sign the HGM rating aims to find.

- Earnings Force and Revisions: While yearly EPS growth has been uneven, the most recent quarterly comparisons show a striking gain, with EPS growth rising to 155.56% and 118.75% in the two prior quarters. Possibly more significant, analysts have changed their estimates higher in the last three months, with the average EPS estimate for the next year growing by 4.6%. Favorable estimate changes are a vital part of momentum, showing increasing belief in future earnings.

- Cash Flow Creation: A notable measure is the company's free cash flow growth, which has risen by over 115% in the trailing twelve months. Firm and increasing cash flow is a sign of a sound, expandable business model and backs the durability of its growth.

These factors, quickening sales, recovering earnings momentum, favorable analyst opinion, and firm cash flow growth, are exactly what the HGM rating combines. They indicate the company's fundamental path is getting better, which is the necessary first stage for momentum investors.

Technical Force and Setup Quality

A firm fundamental story is most effective when joined with a supportive price chart. According to the detailed technical report, Ero Copper performs well here also, having a perfect TA Rating of 10 and a high Setup Rating of 8.

- Outstanding Technical Condition: A TA Rating of 10 is uncommon and shows leading technical force across several timeframes. The report confirms both short-term and long-term trends are favorable. The stock is trading close to its 52-week high and has done better than 95% of the market over the past year. It is placed above all main moving averages (20, 50, 100, and 200-day), which are all moving up, a standard sign of a continued upward trend.

- Pause for Possible Advance: The Setup Rating of 8 indicates a constructive chart formation for entry. The report states that prices have been pausing lately inside a one-month band, with movement lessening. This behavior often comes before a clear price movement. A defined support area has been formed near $25.00, made by a meeting of trendlines and moving averages, giving a sensible zone for a stop-loss order. The study also notes recent purchasing activity from large participants and a pocket pivot sign, adding more support to the positive setup.

The combination is important: the perfect technical rating confirms the market is acknowledging the company's fundamental improvement, while the high setup rating suggests the stock is not too stretched but is instead gathering force for a possible extension of its trend.

A Meeting Chance

ERO Copper shows a case where filter conditions match to emphasize a particular chance. The High Growth Momentum Rating finds the company's gaining fundamental pulse, quickening sales, favorable earnings surprises, and higher analyst changes. At the same time, the technical ratings confirm this force is seen in the price activity, with the stock in a strong upward trend and now pausing in a way that presents a specific risk/reward setup for momentum investors.

This combined view is the filter's goal: to sort the universe for companies where fundamental momentum and technical timing meet. For investors using such a plan, Ero Copper gives a concrete example to examine more.

You can find more stocks that match these joined conditions of high growth momentum and technical advance setups by using the High Growth Momentum Breakout Setups screen.

,

Disclaimer: This article is for information only and does not form investment guidance, a suggestion, or an offer to buy or sell any security. The study is based on data given and filter processes described, which have built-in limits. Investors must do their own complete research, think about their personal financial position and risk comfort, and talk with a qualified financial advisor before making any investment choices. Past results are not a guide for future results.