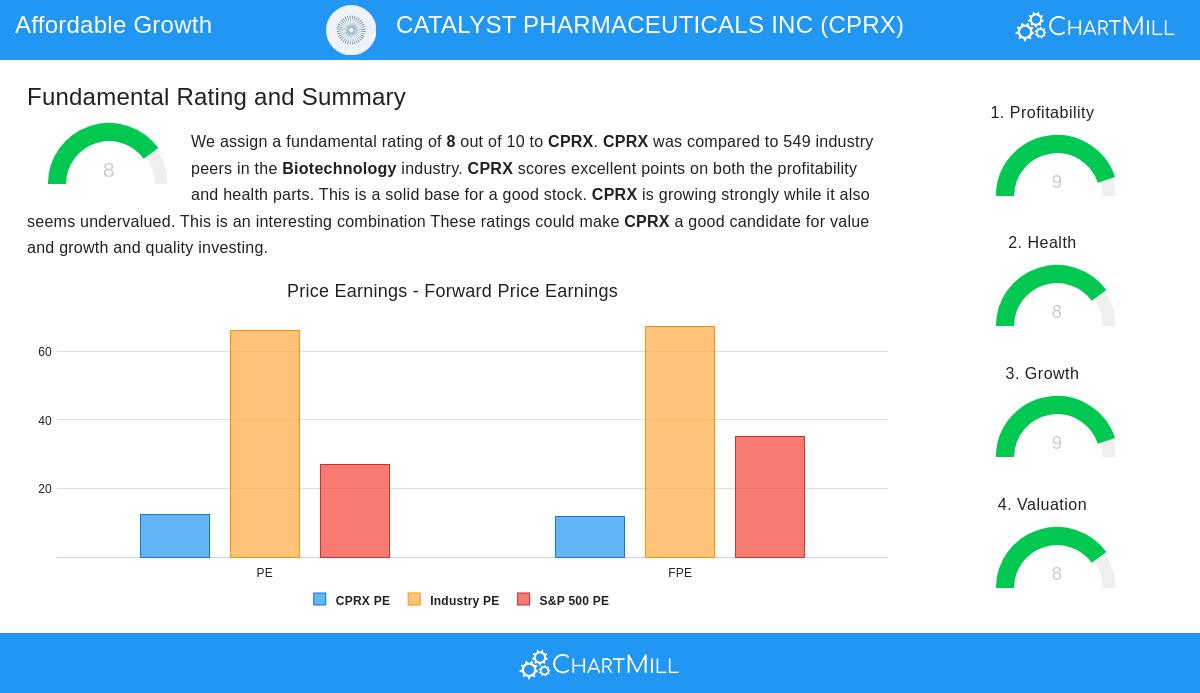

Investors looking for growth opportunities at fair prices often consider the "Affordable Growth" strategy, which finds companies with good growth prospects, steady profits, and strong finances, all while trading at reasonable prices. This method avoids paying too much for fast-growing stocks, balancing potential gains with stability. One stock that meets these standards is Catalyst Pharmaceuticals Inc (NASDAQ:CPRX), a biopharmaceutical company focused on rare diseases.

Growth: A Key Factor

Catalyst Pharmaceuticals stands out with a Growth rating of 9/10, showing its strong past and expected future performance. Over the last year, the company’s earnings per share (EPS) rose by 205.56%, while revenue increased by 28.54%. Its five-year average revenue growth of 36.89% further highlights its ability to grow steadily. Analysts predict EPS growth of 26.50% per year, along with an 11.27% yearly revenue rise. While future growth may slow compared to the past, these numbers remain above industry averages, making CPRX an attractive option for growth-focused investors.

Valuation: Fair Price

Despite its strong growth, CPRX trades at a Price/Earnings (P/E) ratio of 12.26, much lower than the S&P 500 average (26.82) and its biotechnology peers (65.95). Its Forward P/E of 11.72 suggests the stock is priced below its future earnings potential. The company’s Enterprise Value/EBITDA and Price/Free Cash Flow ratios also look favorable, with CPRX cheaper than 98% of its industry competitors. This mix of growth and fair pricing fits well with the Affordable Growth strategy, which looks for stocks not overpriced by valuation measures.

Profitability and Financial Health: A Strong Base

Beyond growth and value, CPRX performs well in profitability and financial strength, earning ratings of 9/10 and 8/10, respectively. Key points include:

- Return on Equity (ROE) of 24.38% and Return on Invested Capital (ROIC) of 21.45%, both in the top 3% of the biotechnology sector.

- Operating Margin of 43.58% and Profit Margin of 37.36%, showing efficient operations and pricing control.

- A debt-free balance sheet, backed by a Current Ratio of 6.71 and Quick Ratio of 6.55, ensuring enough cash to cover obligations.

These numbers confirm CPRX’s ability to maintain growth without risking financial health—a key factor for Affordable Growth investors who value long-term business strength.

Why These Standards Matter

The Affordable Growth strategy reduces risk by avoiding overpriced stocks while focusing on companies with proven growth and solid fundamentals. CPRX’s strong growth, fair valuation, and excellent profitability make it a top choice. For a closer look at its details, see the full analysis here.

Find More Affordable Growth Stocks

CPRX is just one example of a stock that fits this strategy. Investors can discover similar opportunities using ChartMill’s Affordable Growth screener, which filters for high-growth, fairly priced companies with strong fundamentals.

Disclaimer: This article is not investment advice. Always do your own research or consult a financial advisor before making investment decisions.