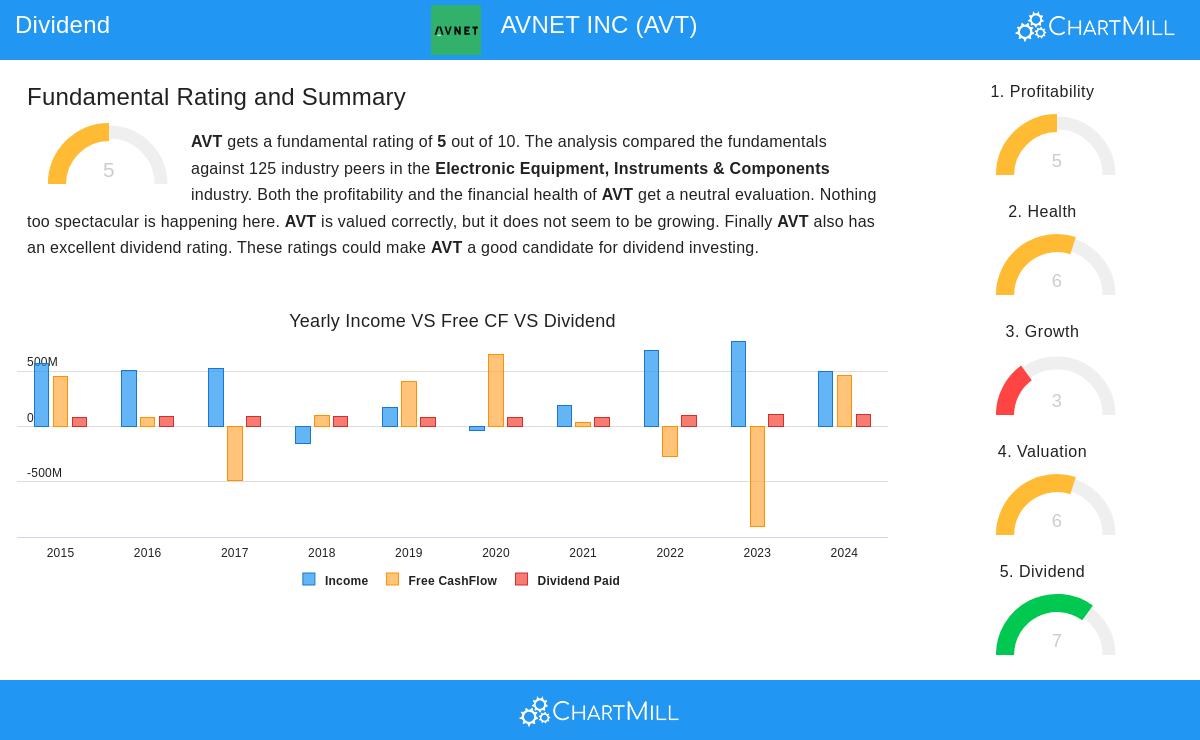

AVNET INC (NASDAQ:AVT) stands out as a strong candidate for dividend investors, according to our screening criteria. The company combines a solid dividend profile with reasonable profitability and financial health, making it an interesting option for income-focused portfolios.

Dividend Strength

- Attractive Yield: AVT offers a dividend yield of 2.61%, which is above both the industry average (2.06%) and the S&P 500 average (2.38%).

- Consistent Growth: The company has increased its dividend at an annual rate of 9.30% over the past five years, demonstrating a commitment to rewarding shareholders.

- Long Track Record: AVT has paid dividends for at least 10 years without reductions, indicating reliability.

- Sustainable Payout: With a payout ratio of 35.81%, the dividend appears well-covered by earnings, though investors should monitor whether future earnings growth keeps pace with dividend increases.

Profitability & Financial Health

- Decent Profitability: AVT scores a 5/10 in profitability, with a return on equity (6.49%) and return on invested capital (6.87%) in line with industry peers. Margins have improved recently, though gross margins remain below average.

- Solid Financial Health: The company holds a 6/10 health rating, supported by manageable debt levels (Debt/Equity of 0.51) and a healthy Altman-Z score (3.46), suggesting low bankruptcy risk. Liquidity is adequate, with a current ratio of 2.44.

Valuation

AVT trades at a reasonable P/E of 13.13, below both the S&P 500 (26.31) and most industry peers. Its forward P/E of 9.92 further suggests the stock is undervalued relative to growth expectations.

For a deeper look, review the full fundamental report on AVT.

Our Best Dividend Stocks screener provides more high-quality dividend stock ideas.

Disclaimer

This is not investment advice. Always conduct your own research before making investment decisions.