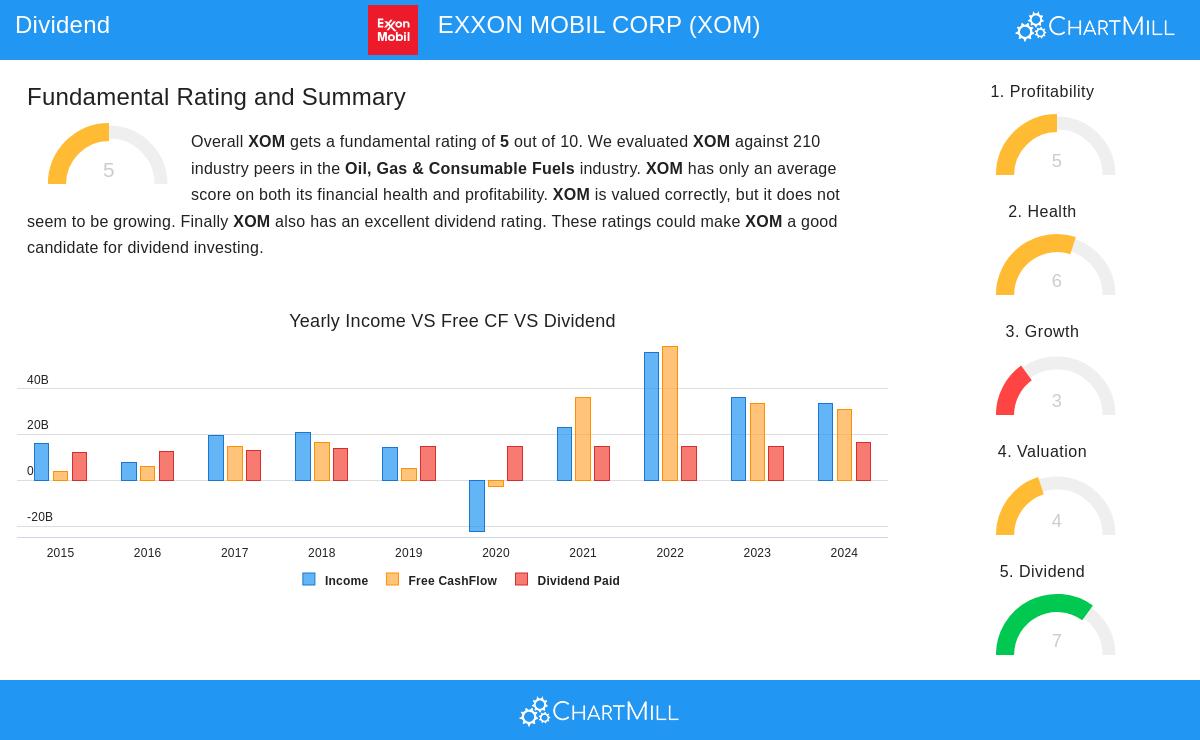

EXXON MOBIL CORP (NYSE:XOM) stands out as a strong candidate for dividend investors, according to our Best Dividend Stocks screen. The company combines a solid dividend profile with reasonable profitability and financial health, making it a noteworthy option for income-focused portfolios.

Dividend Strength

- Dividend Yield: XOM offers a yield of 3.55%, which is above the S&P 500 average of 2.35%. While not the highest in its sector, it remains competitive.

- Reliable Track Record: The company has paid dividends for at least 10 years without reductions, demonstrating consistency.

- Sustainable Payout: With a payout ratio of 51.94%, XOM maintains a balance between rewarding shareholders and retaining earnings for growth.

Profitability & Financial Health

- Stable Margins: XOM’s operating margin of 12.76% has improved in recent years, reflecting efficient operations.

- Strong Solvency: A low debt-to-equity ratio of 0.12 and a healthy Altman-Z score of 4.06 indicate financial stability.

- Positive Cash Flow: The company has generated positive operating cash flow over the past five years, supporting dividend payments.

Valuation & Growth

- Reasonable Valuation: XOM trades at a P/E of 14.39, below the S&P 500 average, suggesting it is fairly priced.

- Earnings Growth: While recent earnings growth has been uneven, analysts expect an annual EPS increase of 12.57% in the coming years.

For a deeper analysis, review the full fundamental report on XOM.

Our Best Dividend Stocks screener provides more high-quality dividend ideas.

Disclaimer

This is not investment advice. Always conduct your own research before making investment decisions.