Newmont Corp (NYSE:NEM) stands out as a potential value opportunity in the metals and mining sector. The company’s fundamentals suggest it is trading below its intrinsic value while maintaining strong profitability and financial health.

Valuation

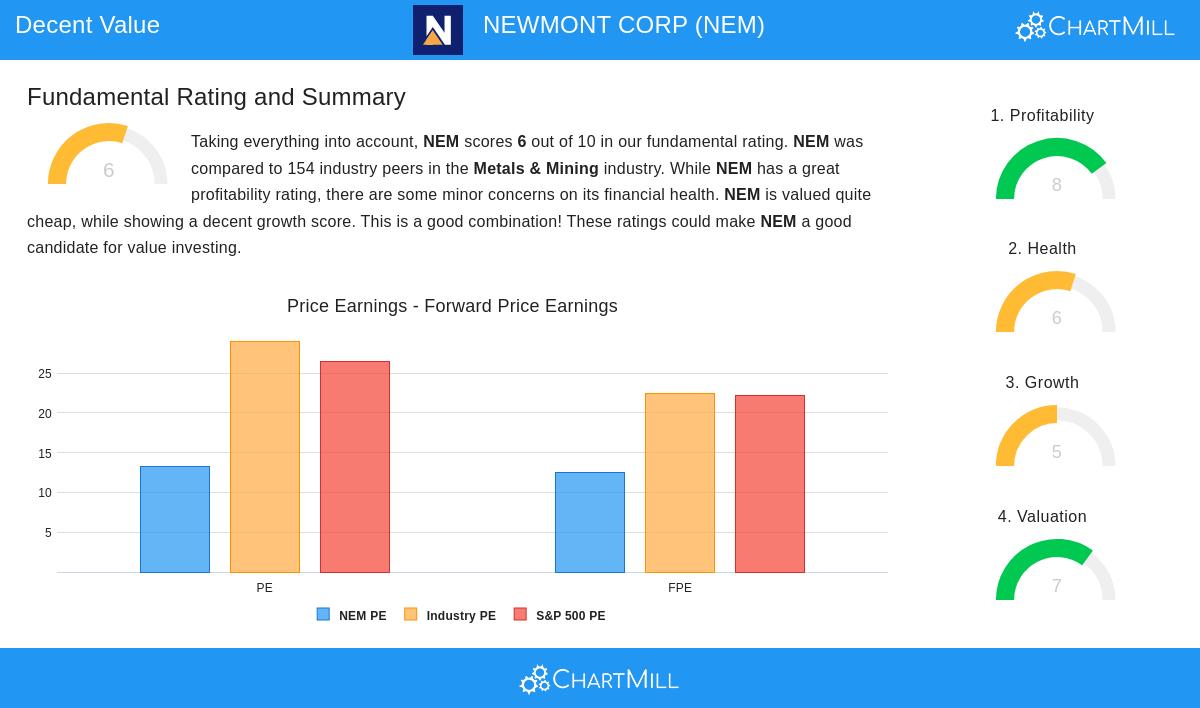

Newmont’s valuation metrics indicate the stock is priced attractively compared to peers:

- P/E Ratio: At 13.22, NEM trades below the industry average (29.01) and the S&P 500 (26.43).

- Forward P/E: 12.47, also lower than both the sector and broader market.

- Enterprise Value/EBITDA: Ranks cheaper than 83.8% of industry peers.

- Price/Free Cash Flow: More favorable than 87% of competitors.

These metrics suggest the stock is undervalued relative to its earnings and cash flow potential.

Profitability

Newmont demonstrates strong profitability, with key strengths including:

- Return on Equity (ROE): 16.22%, outperforming nearly 89% of industry peers.

- Profit Margin: 25.77%, ranking in the top 6% of the sector.

- Operating Margin: 35.28%, well above the industry average.

Despite recent margin declines, the company remains highly profitable compared to competitors.

Financial Health

The company maintains a solid balance sheet:

- Debt/Equity Ratio: A manageable 0.25, indicating limited reliance on debt.

- Current Ratio: 1.98, suggesting sufficient liquidity for short-term obligations.

- Debt/FCF Ratio: 1.78, meaning debt could be repaid in under two years using free cash flow.

While the Altman-Z score (2.41) places NEM in a "grey zone," its overall financial position remains stable.

Growth

Recent performance shows strong growth, though future projections are mixed:

- Past Year EPS Growth: +140.2%, with a 5-year average of +21.6%.

- Revenue Growth: +49.5% over the past year, averaging +13.9% annually.

- Future Outlook: Analysts expect slower EPS growth (+3.5%) and a revenue decline (-5.3%).

While near-term growth may moderate, the stock’s valuation appears to account for these headwinds.

For a deeper dive into Newmont’s fundamentals, review the full analysis report.

Our Decent Value Stocks screener identifies more stocks with strong valuations and fundamentals.

Disclaimer

This is not investment advice. Always conduct your own research before making investment decisions.