U.S. Markets Rise on Trade Deal Hopes and Boeing Boost

Wall Street ended Thursday in the green, buoyed by optimism around a potential trade deal between the United States and the United Kingdom.

The Dow Jones climbed 0.6%, while the S&P 500 gained the same amount, closing at 5,663.94 points. The Nasdaq outperformed with a 1.1% rise, finishing at 17,928.14 points.

President Donald Trump fueled investor confidence by announcing a preliminary trade agreement with the U.K., calling it a “framework” for future negotiations. Trump also encouraged Americans to buy stocks, citing his trade policies and tax plans as bullish catalysts.

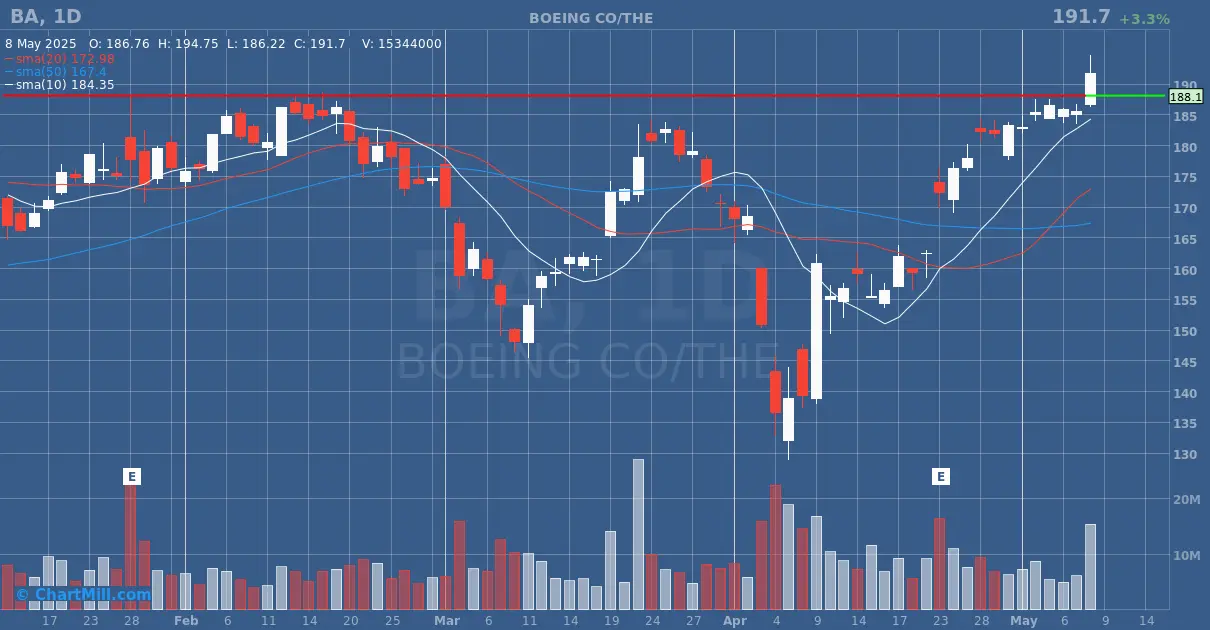

Boeing Leads the Charge

A standout performer was Boeing (BA | +3.31%), which surged on two fronts.

First, U.S. Commerce Secretary Howard Lutnick revealed a $10 billion aircraft order from a British airline. While the name wasn't immediately disclosed, sources later indicated IAG, the parent of British Airways, could be planning to purchase 30 Boeing 787 Dreamliners.

Additionally, White House advisor Peter Navarro offered strong verbal support, calling Boeing “our national champion in aerospace,” and confirming that the Trump administration would ensure its long-term success.

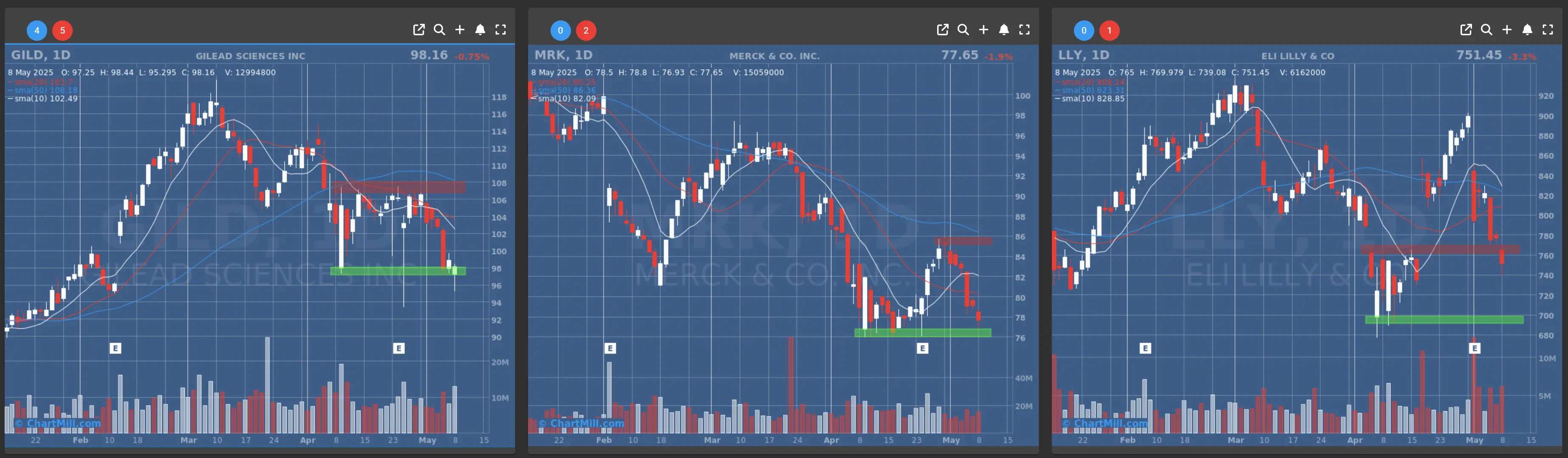

Pharma Stocks Take a Hit

Healthcare stocks lagged the market.

President Trump proposed a new pricing strategy that would tie U.S. drug prices to those abroad, putting pressure on pharmaceutical companies. As a result, Gilead (GILD | -0.75%), Eli Lilly (LLY | -3.25%), and Merck (MRK | -1.86%) all traded lower.

The U.S. is known for high drug prices due to limited government regulation, making it a key market for biotech firms. The new policy, if enacted, could challenge the profitability of the sector.

Match Group Stumbles Amid Layoffs

Match Group (MTCH | -9.58%), the parent company of Tinder, tumbled after announcing it would cut 13% of its workforce. CEO Spencer Rascoff said the move is aimed at centralizing operations and eliminating redundancies.

Although the company projected an operating profit below analyst expectations for the second quarter, analysts believe the restructuring could save $100 million annually, potentially boosting margins in the long run.

Other Noteworthy Movers

- MicroStrategy (MSTR | +5.58%) soared as Bitcoin climbed past $100,000.

- ConocoPhillips (COP | +1.27%) rose after reporting stronger-than-expected earnings and lowering its 2025 investment outlook.

- Restaurant Brands International (QSR | -0.53%), owner of Burger King, fell after a disappointing earnings report.

- Arm Holdings (ARM | -6.18%) dropped following a weak outlook.

- Nvidia (NVDA | +0.26%) edged higher as the U.S. Commerce Department showed no signs of enforcing AI chip export restrictions under the new administration.

Macroeconomic Signals

- Initial jobless claims fell to 228,000, slightly better than expected.

- Labor productivity declined 0.8% in Q1, its first drop since Q2 2022.

- Unit labor costs surged 5.7%, pointing to continued wage pressure.

- Wholesale inventories rose 0.4%, just below forecasts.

Oil Prices Rebound Strongly

Oil prices rallied on trade optimism and anticipation of upcoming U.S.–China talks. West Texas Intermediate (WTI) jumped 3.2% to $59.91 per barrel, while Brent crude also rose around 3%.

Analysts noted that the markets are closely tracking headlines surrounding international trade and geopolitical tensions. Hopes for reduced tariffs and stronger global demand helped fuel the oil rebound.

However, concerns remain over OPEC+’s potential production increases, which could lead to oversupply, keeping volatility in energy markets high.

Fed Policy and Market Sentiment

The Federal Reserve held interest rates steady between 4.25% and 4.50%, maintaining its cautious stance. Despite cooling inflation indicators, analysts from HSBC warned that if inflation concerns intensify, rate cuts may be postponed, potentially triggering another sell-off.

Trump continued his public feud with Fed Chair Jerome Powell, calling him a “fool” and blaming him for misreading inflation trends.

Strong Earnings Season

According to ING, 77% of the S&P 500 companies that have reported earnings so far beat expectations, with average earnings surprises of 8.5%. Actual earnings growth is running at 12%, well above the 7% forecasted at the start of earnings season.

Looking Ahead

Eyes now turn to Switzerland this weekend, where U.S. officials will meet with China’s Vice Premier He Lifeng for renewed economic talks. Investors will be watching closely for any signs of progress that could further boost global risk sentiment.

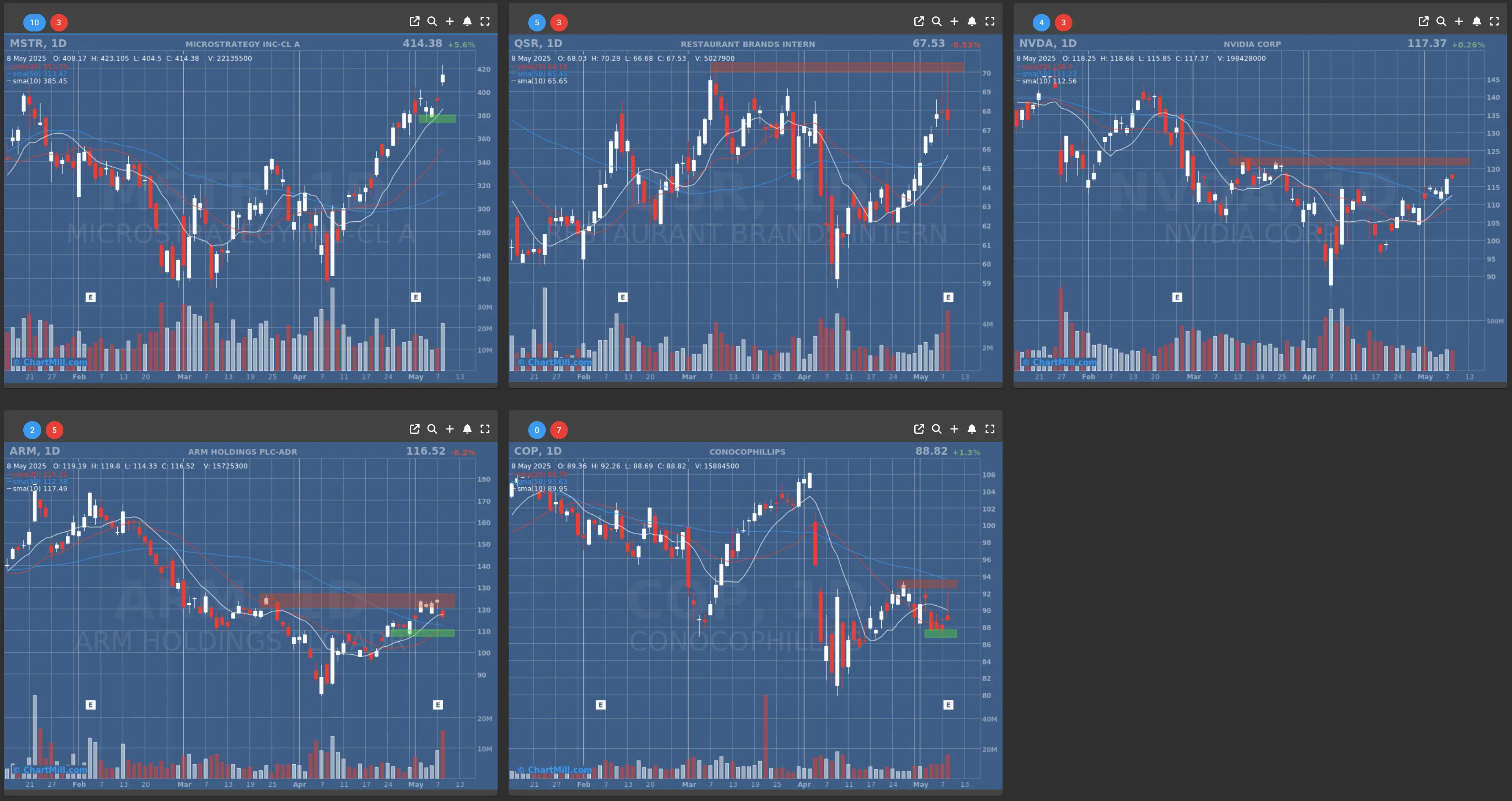

Daily Market Analysis – May 8, 2025 (After Market Close)

Short Term Trend

- Short-Term Trend: Bullish (no change)

- Support at $490 - $550

- Resistance at $570 - $580

- Volume: Below average (50)

- Pattern: Gap Up - Doji Candle - Double Top

- Short-Term Trend: Bullish (no change)

- Support at $470

- Resistance at $490

- Volume: Below average (50)

- Pattern: Gap Up - Doji Candle - Double Top

- Short-Term Trend: Bullish (no change)

- Support at $200

- Resistance at $210-215

- Volume: Slightly below average (50)

- Pattern: Gap Up

Long Term Trend

- Long-Term Trend: Neutral (no change)

- Long-Term Trend: Neutral (no change)

- Long-Term Trend: Down (no change)

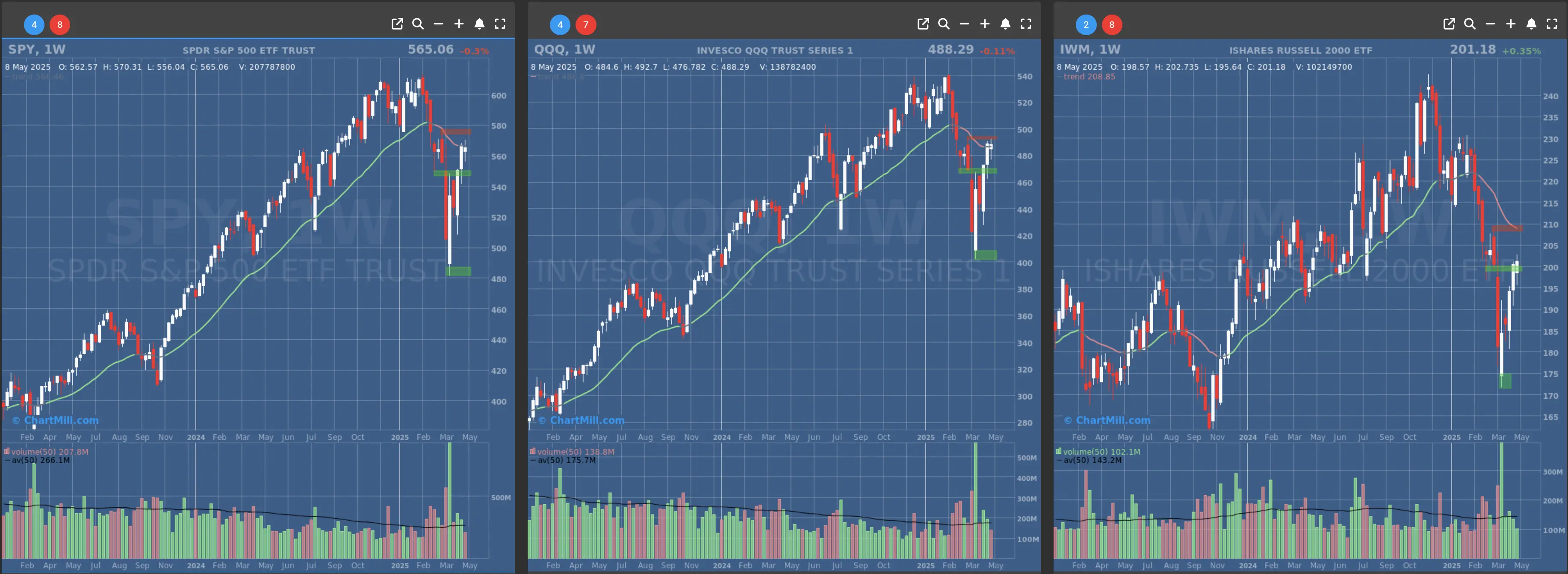

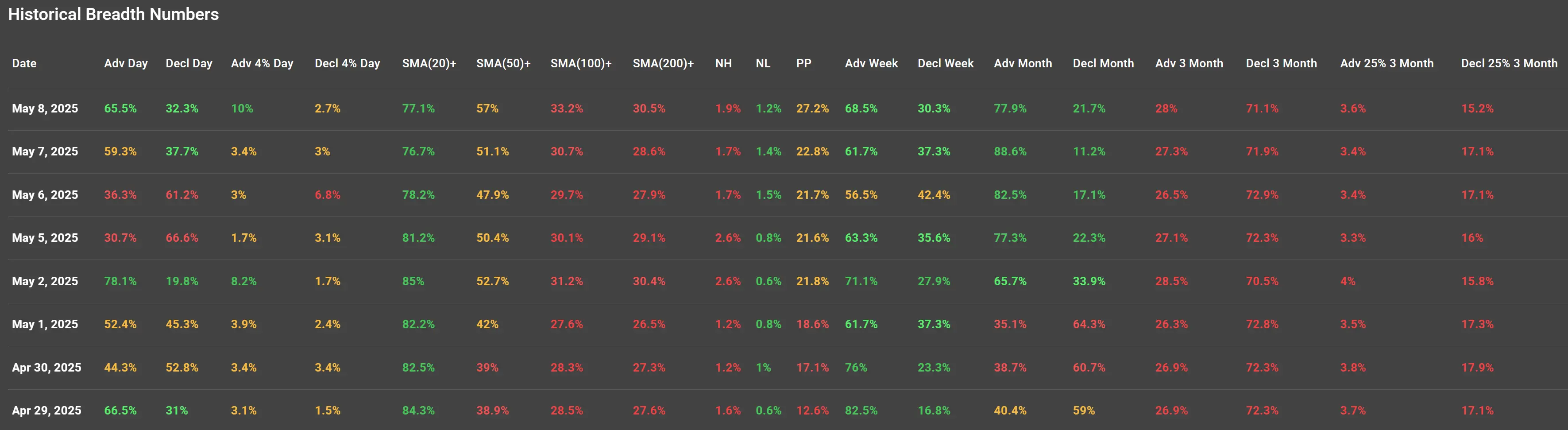

Market Breadth Analysis for May 8, 2025 (After Market Close)

The U.S. equity markets showed a broad-based advance on May 8, with underlying strength visible across nearly all short- and intermediate-term metrics. After a volatile start to the month, Thursday’s session marked the second consecutive day of improving internal market conditions.

Broad Participation Returns

-

65.5% of all stocks finished higher on the day, while only 32.3% declined.

-

Even more encouraging, 10% of all stocks gained more than 4%, a strong signal of upside momentum expanding beyond the mega-caps.

-

In contrast, only 2.7% of stocks saw losses exceeding 4%.

This kind of positive skew in day-to-day advances vs. declines indicates that the rally is gaining depth — more stocks are participating in the upside, and those gains are becoming more meaningful.

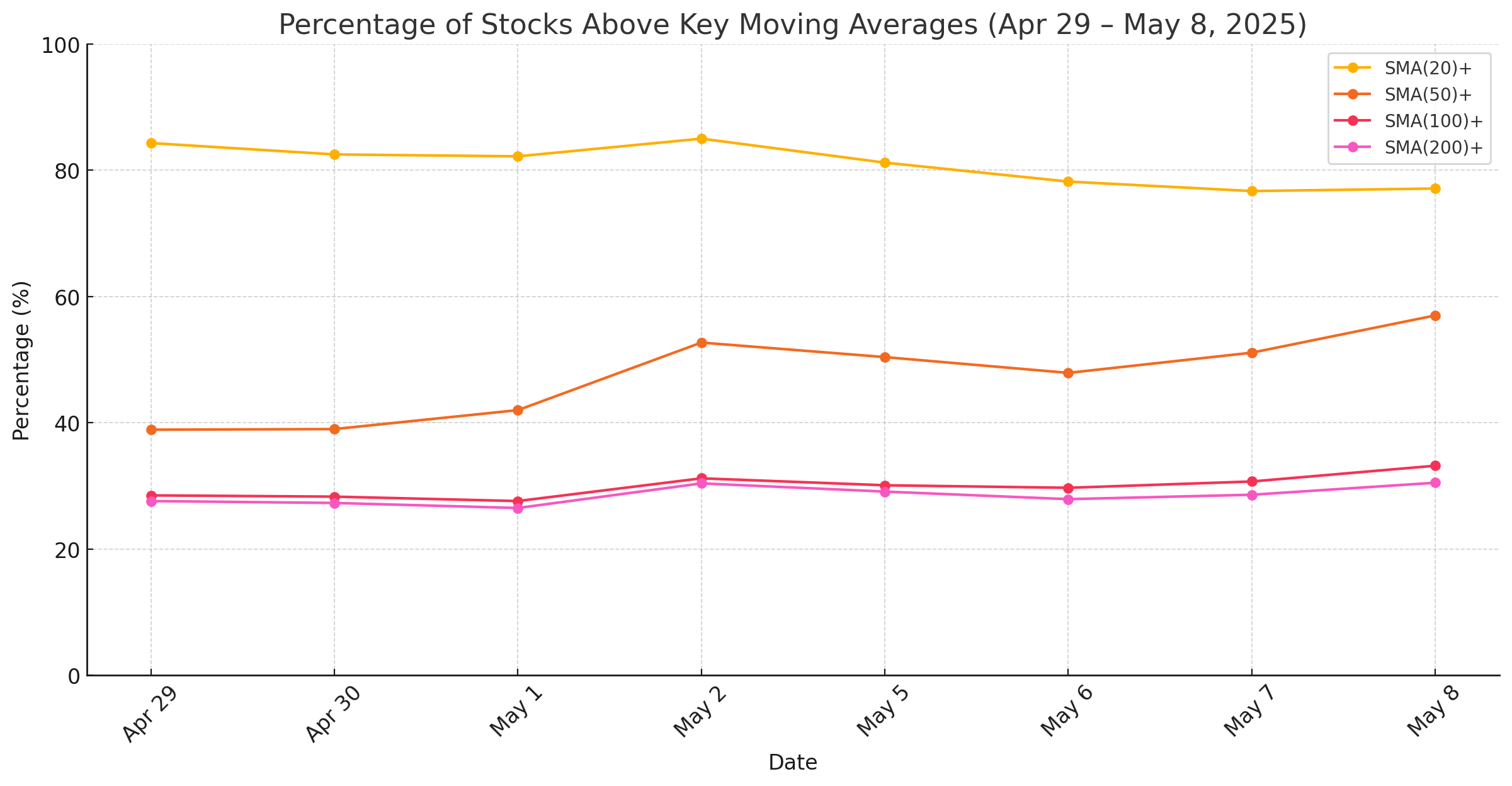

Moving Average Breadth – A Healthy Recovery in Progress

-

Participation above key moving averages remains on the rise, signaling a market that’s trying to transition from rebound mode to a more sustainable uptrend:

-

77.1% of stocks are now trading above their 20-day SMA.

-

57% are above their 50-day SMA — the highest reading in the past two weeks.

-

Participation above the 100-day and 200-day SMAs remains modest at 33.2% and 30.5% respectively, but both continue to trend upward.

This suggests that the market is currently short-term overbought, but still has room to run on longer timeframes if follow-through buying persists.

Weekly and Monthly Breadth Improving

-

Over the past week, 68.5% of stocks are higher, while 30.3% are lower.

-

The monthly picture looks even stronger: 77.9% of stocks are in the green for the past 21 trading days.

-

On a three-month basis, only 28.9% of stocks are up, versus a heavy 71.1% still in negative territory. That means the recent rally is still in repair mode from prior damage.

-

It’s worth noting that only 3.6% of stocks have risen more than 25% in the past 3 months, a relatively low figure that reflects a lack of strong leadership or explosive breakout momentum — at least for now.

New Highs vs. New Lows: A Modest Bullish Edge

The New High/New Low ratio remains muted, but leaned bullish:

-

1.9% of stocks hit new 52-week highs.

-

1.2% registered new lows.

This reading continues to improve week over week and is another sign that downside pressure is easing, though a real breakout in new highs is still lacking.

Summary and Outlook

Thursday's market action was supported by a solid expansion in short-term breadth, alongside improving intermediate metrics like the 50-day SMA participation rate.

While longer-term breadth (3-month trend, 200-day SMA) remains weak, the market is in recovery mode, and buying pressure is broadening out.

That said, the lack of explosive leadership and the still-elevated percentage of stocks in 3-month drawdowns signal that this is a rally within a correction, not yet a confirmed new bull leg.

A sustained move higher will require increased participation above the 200-day SMA and an uptick in stocks hitting new highs.