MICRON TECHNOLOGY INC (NASDAQ:MU) Combines High Growth Momentum with Bullish Technical Setup

By Mill Chart

Last update: Oct 1, 2025

A systematic method for finding good investment chances joins basic growth speed with technical breakout formations. This process filters for firms showing solid earnings speed increases, growing profit margins, and favorable analyst changes, key parts of the ChartMill High Growth Momentum Rating, while also showing good technical condition and consolidation formations using the Technical Rating and Setup Quality scores. Stocks that fit these conditions offer the double benefit of basic business speed along with positive chart layouts for possible entry spots.

Fundamental Growth Momentum

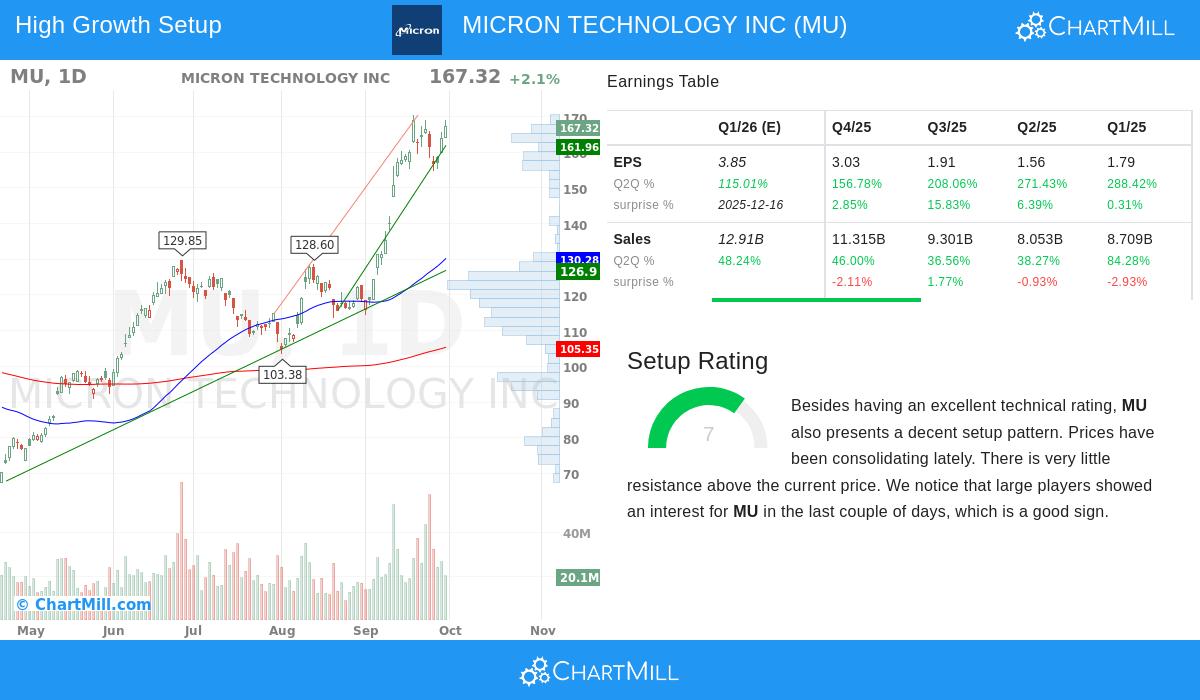

MICRON TECHNOLOGY INC (NASDAQ:MU) shows very good growth traits that match high speed investment plans. The firm's earnings results display notable speed increases across several time periods, with special force in recent quarterly reports. The basic view shows several notable data items:

- EPS growth has increased greatly, with trailing twelve-month growth over 552% and recent quarterly growth rates from 156% to 288% compared to the same times last year

- Free cash flow per share has grown by about 1,278% over the past year, showing solid operational effectiveness and financial condition

- Profit margins have grown notably, changing from about 3.1% two years ago to present levels above 28%, showing better pricing control and cost handling

- The firm has exceeded EPS estimates in all of the last four quarters, with a typical surprise of 6.3%

- Analyst view stays positive, with next-year EPS estimates changed upward by over 20% in the past three months

These measures together add to MU's High Growth Momentum Rating of 7, showing firm basic speed across several areas. The joining of speeding earnings, growing margins, and positive changes forms the kind of growth picture that speed investors usually look for, as these items often come before continued price gains.

Technical Strength and Setup Quality

From a technical view, MICRON TECHNOLOGY INC shows equally notable traits. The stock now has a Technical Rating of 9, putting it in the market's strongest performers from a chart view. The technical study shows several supporting items:

- Both long-term and short-term directions stay firmly positive, with the stock trading near its 52-week high

- The stock shows solid relative force, doing better than 81% of semiconductor industry friends

- Several moving averages (20-day, 50-day, 100-day, and 200-day) are all moving upward and placed below the present price, making a layered support frame

- Trading volume stays good with a typical amount over 22 million shares daily, giving enough fluidity

The Setup Quality Rating of 7 shows the stock is now making a consolidation formation that may offer a possible entry chance. Recent trading action has shown big player interest, with large parties showing buying action in recent sessions. The technical frame finds three separate support areas between $126 and $163, giving clear risk control levels for possible positions.

Joined Assessment

The meeting of solid basic growth speed and helpful technical placement makes MICRON TECHNOLOGY INC especially notable for speed-focused investors. The firm's notable earnings speed increase and margin growth give the basic push that usually powers continued price action, while the technical formation offers a framed method to possible entry. This joining handles both the "what to buy" question through basic study and the "when to buy" question through technical formation spotting.

For investors looking for like chances that join growth speed with technical breakout formations, more filtering results can be found using the High Growth Momentum Breakout Setups Screen. This tool methodically finds firms showing both solid business speed and favorable chart forms for more study.

Disclaimer: This study is for information only and does not make investment guidance, suggestion, or backing of any safety. Investors should do their own study and talk with money helpers before making investment choices. Past results do not promise future results, and all investments have risk including possible loss of original money.

336.63

+3.28 (+0.98%)

Find more stocks in the Stock Screener