GSV Key Statistics, Chart & Performance

The current stock price of GSV is 0.402 USD. In the past month the price increased by 37.53%. In the past year, price decreased by -20%.

GSV Technical Analysis

ChartMill assigns a technical rating of 6 / 10 to GSV. When comparing the yearly performance of all stocks, GSV turns out to be only a medium performer in the overall market: it outperformed 56.12% of all stocks.

GSV Fundamental Analysis

ChartMill assigns a fundamental rating of 4 / 10 to GSV. No worries on liquidiy or solvency for GSV as it has an excellent financial health rating, but there are worries on the profitability.

GSV Financial Highlights

Over the last trailing twelve months GSV reported a non-GAAP Earnings per Share(EPS) of -0.03. The EPS increased by 31.67% compared to the year before.

| Industry Rank | Sector Rank | ||

|---|---|---|---|

| PM (TTM) | N/A | ||

| ROA | -3.34% | ||

| ROE | N/A | ||

| Debt/Equity | 0 |

GSV Forecast & Estimates

9 analysts have analysed GSV and the average price target is 0.72 USD. This implies a price increase of 78.58% is expected in the next year compared to the current price of 0.402.

GSV Ownership

About GSV

Company Profile

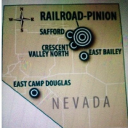

Gold Standard Ventures Corp. operates as a mineral exploration company. The company is headquartered in Vancouver, British Columbia and currently employs 9 full-time employees. The company went IPO on 2005-01-07. The firm is focused on developing the South Railroad Project. The South Railroad project is located in the Bullion mining district of the southern Carlin trend in Nevada. The project is 100% owned and comprises of 21,000 hectares. The Lewis project is located in the Battle is located in the Battle Mountain Mining District, Lander County, Nevada, United States of America.

Gold Standard Ventures Corp. operates as a mineral exploration company. The company is headquartered in Vancouver, British Columbia and currently employs 9 full-time employees. The company went IPO on 2005-01-07. The firm is focused on developing the South Railroad Project. The South Railroad project is located in the Bullion mining district of the southern Carlin trend in Nevada. The project is 100% owned and comprises of 21,000 hectares. The Lewis project is located in the Battle is located in the Battle Mountain Mining District, Lander County, Nevada, United States of America.

Company Info

GOLD STANDARD VENTURES CORP

815 West Hastings Street, Suite 610

Vancouver BRITISH COLUMBIA V6C 1B4 CA

CEO: Jason Attew

Employees: 9

Phone: 16046695702.0

GOLD STANDARD VENTURES CORP / GSV FAQ

What does GSV do?

Gold Standard Ventures Corp. operates as a mineral exploration company. The company is headquartered in Vancouver, British Columbia and currently employs 9 full-time employees. The company went IPO on 2005-01-07. The firm is focused on developing the South Railroad Project. The South Railroad project is located in the Bullion mining district of the southern Carlin trend in Nevada. The project is 100% owned and comprises of 21,000 hectares. The Lewis project is located in the Battle is located in the Battle Mountain Mining District, Lander County, Nevada, United States of America.

What is the stock price of GOLD STANDARD VENTURES CORP today?

The current stock price of GSV is 0.402 USD. The price increased by 0.5% in the last trading session.

Does GOLD STANDARD VENTURES CORP pay dividends?

GSV does not pay a dividend.

What is the ChartMill rating of GOLD STANDARD VENTURES CORP stock?

GSV has a ChartMill Technical rating of 6 out of 10 and a ChartMill Fundamental rating of 4 out of 10.

Can you provide the number of employees for GOLD STANDARD VENTURES CORP?

GOLD STANDARD VENTURES CORP (GSV) currently has 9 employees.