Growth investing strategies often focus on identifying companies with strong expansion potential, but many investors seek to balance this growth with reasonable valuations to avoid overpaying for future prospects. The "Affordable Growth" method targets stocks demonstrating solid growth paths while maintaining good financial health and profitability, all at valuations that do not seem high. This process helps investors find growth chances without taking on too much valuation risk.

Sprouts Farmers Market Inc (NASDAQ:SFM) works as a specialty grocery retailer focusing on natural and organic products, with more than 440 stores across 24 states. The company aims at health-conscious buyers through its perishable and non-perishable product groups, placing itself in the competitive grocery field with a clear health and wellness focus.

Growth Path

Sprouts shows notable growth features that fit well with affordable growth standards. The company's recent results display strong expansion measures:

- Earnings Per Share growth of 51.88% over the past year

- Average yearly EPS growth of 24.64% over several years

- Revenue growth of 16.83% in the most recent year

- Expected future EPS growth of 18.03% each year

- Planned revenue growth increase to 11.14% each year

These growth measures point to solid operational momentum, with the company effectively growing both top-line revenue and bottom-line profitability. The rise in planned revenue growth implies the company's strategic efforts are becoming more effective in the market.

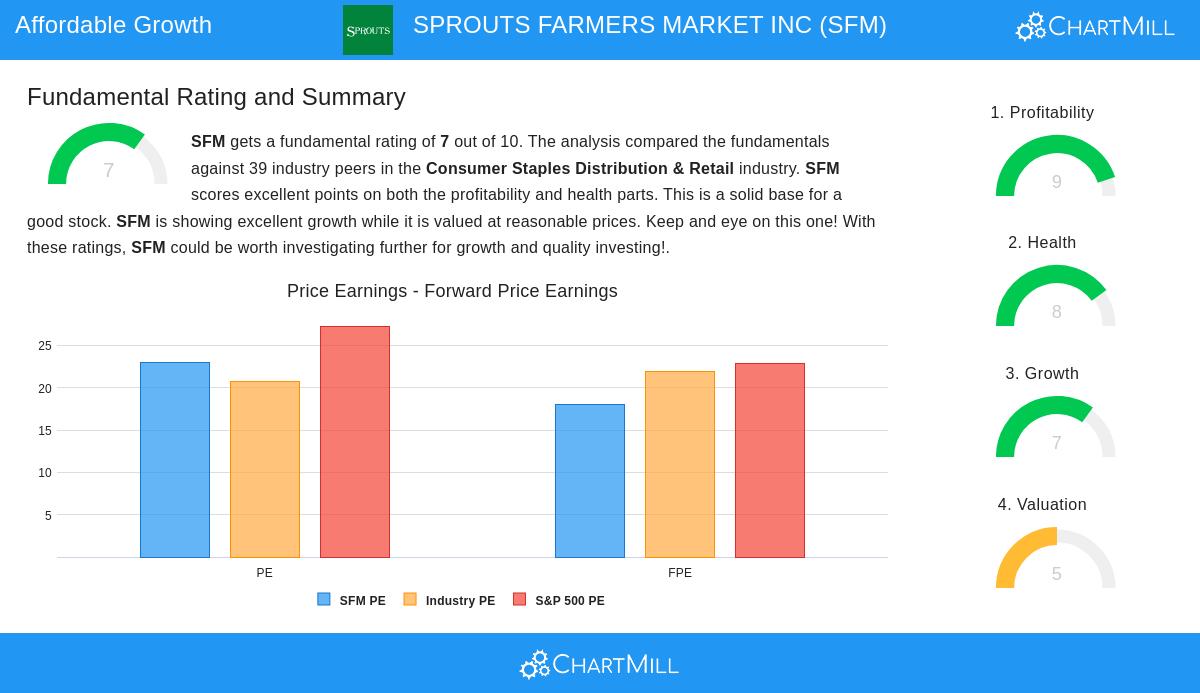

Valuation Check

The valuation view shows a varied but mostly acceptable situation considering the company's growth outline:

- Current P/E ratio of 22.95 places SFM near industry average levels

- Forward P/E ratio of 18.05 looks good compared to both industry and S&P 500 averages

- PEG ratio shows payment for growth at acceptable levels

- Enterprise Value to EBITDA and Price/Free Cash Flow ratios match industry standards

While the absolute P/E multiple might look high to some value investors, the forward-looking measures and growth payment suggest the valuation stays acceptable relative to the company's growth outlook and industry position.

Profitability Quality

Sprouts displays excellent profitability measures that give foundational support for its growth narrative:

- Return on Assets of 12.82% puts it in the top 5% of industry peers

- Return on Equity of 35.75% is with industry leaders

- Return on Invested Capital of 15.85% is better than 97% of competitors

- Profit margin of 5.77% and operating margin of 7.69% both are in the top ten percent

- Gross margin of 38.69% shows pricing ability within the competitive grocery sector

These profitability measures not only support current activities but provide the financial room to pay for future growth projects without too much outside financing.

Financial Condition

The company keeps good financial condition with some detailed points:

- Very good solvency measures with Altman-Z score of 5.67 showing low bankruptcy risk

- Very small debt levels with Debt/Equity ratio of 0.00

- Excellent Debt to Free Cash Flow ratio of 0.02

- Current and quick ratios under industry averages, though lessened by strong profitability and cash flow creation

While the current ratio of 0.98 needs watching, the company's solid cash flow creation and minimal debt load provide significant financial room to handle short-term responsibilities.

Investment Points

For investors looking for growth at acceptable prices, Sprouts presents a notable case with its mix of a strong growth path, excellent profitability, and workable valuation. The company's position in the health-focused grocery section matches with consumer movements toward wellness and natural products, giving possible support for continued expansion.

The foundational analysis report for Sprouts Farmers Market gives more detailed measures and comparisons for deeper review. View the complete foundational analysis to look at all rating parts and industry comparisons.

Investors curious about finding similar affordable growth chances can look at more screening results using our Affordable Growth stock screener, which finds companies meeting similar standards for growth, valuation, condition, and profitability.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice, recommendation, or endorsement of any security. Investors should conduct their own research and consult with financial advisors before making investment decisions. Past performance does not guarantee future results.