RBC BEARINGS INC (NYSE:RBC) stands out as a potential candidate for quality investors, meeting key criteria from our Caviar Cruise screen. The company, which specializes in precision bearings and components for aerospace, defense, and industrial markets, demonstrates solid profitability, manageable debt, and consistent growth. Below, we examine why RBC fits the quality investing profile.

Key Strengths

-

High Return on Invested Capital (ROIC)

RBC’s ROIC (excluding cash and goodwill) is 26.01%, well above the 15% threshold for quality stocks. This indicates efficient use of capital to generate profits. -

Strong EBIT Growth

The company’s 5-year EBIT growth stands at 18.70%, outpacing many peers. This suggests improving operational efficiency and pricing power. -

Healthy Debt Management

With a Debt-to-Free Cash Flow ratio of 3.80, RBC could repay its debt in under four years using current cash flows—a sign of financial stability. -

Exceptional Profit Quality

RBC’s 5-year average Profit Quality (FCF/Net Income) is 173.26%, meaning it converts net income into free cash flow at an impressive rate.

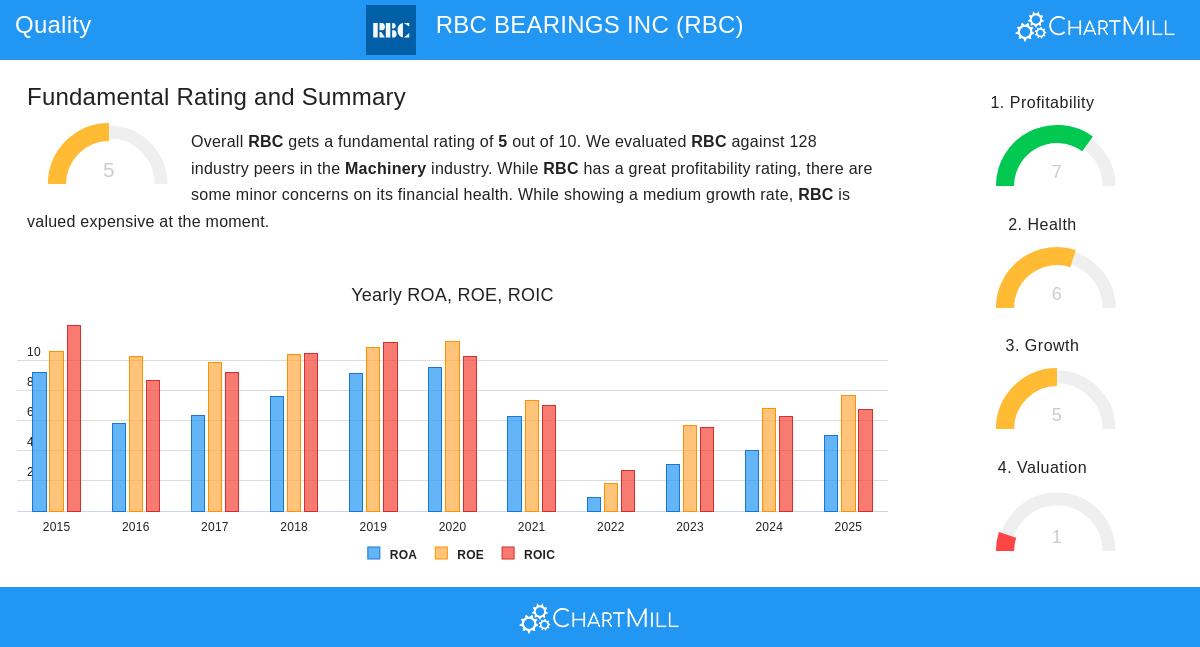

Fundamental Analysis Summary

Our fundamental report highlights RBC’s strengths and weaknesses:

- Profitability (7/10): Strong margins, though ROIC trails the industry average.

- Financial Health (6/10): Solid liquidity and solvency, but share dilution is a concern.

- Valuation (1/10): The stock appears expensive, trading at a P/E of 37.05.

- Growth (5/10): Past revenue and EPS growth are robust, but future estimates show moderation.

For investors seeking quality stocks with strong fundamentals, RBC’s operational strengths make it worth further research.

Our Caviar Cruise screener lists more quality investment candidates and is updated regularly.

Disclaimer

This is not investing advice! The article highlights observations at the time of writing, but you should conduct your own analysis before making investment decisions.