Palantir Technologies, the U.S.-based software company known for its deep ties with government and intelligence agencies, kicked off 2025 with a strong first quarter, surpassing expectations on both revenue and profit. Despite the stellar performance, investor enthusiasm cooled — likely due to the company's lofty valuation.

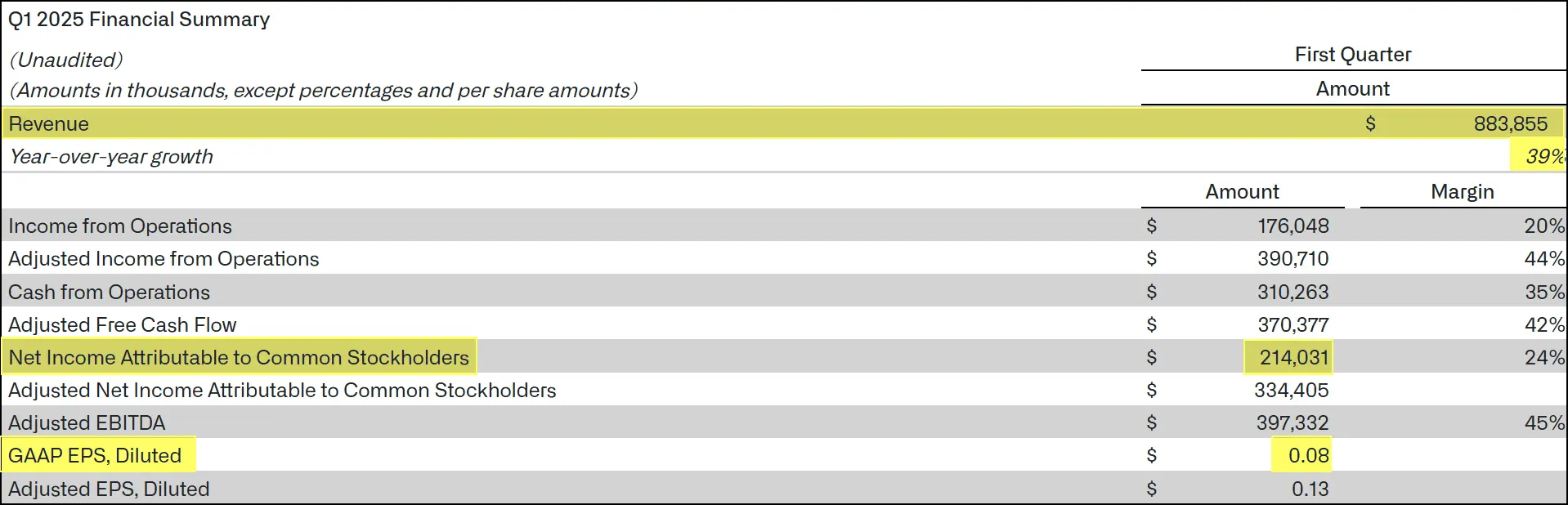

In Q1, Palantir posted revenue of $884 million, up 39% year-over-year and ahead of analysts’ estimates of $863 million. Adjusted earnings per share landed at $0.13, in line with Wall Street forecasts. Net income reached $214 million, or $0.08 per share.

CEO Alex Karp described the ongoing growth as "relentless and unparalleled," fueled by an "unstoppable whirlwind" of AI demand. He emphasized that Palantir's results only partially reflect the company’s broader value, pointing to its unconventional long-term vision and unique approach to growth.

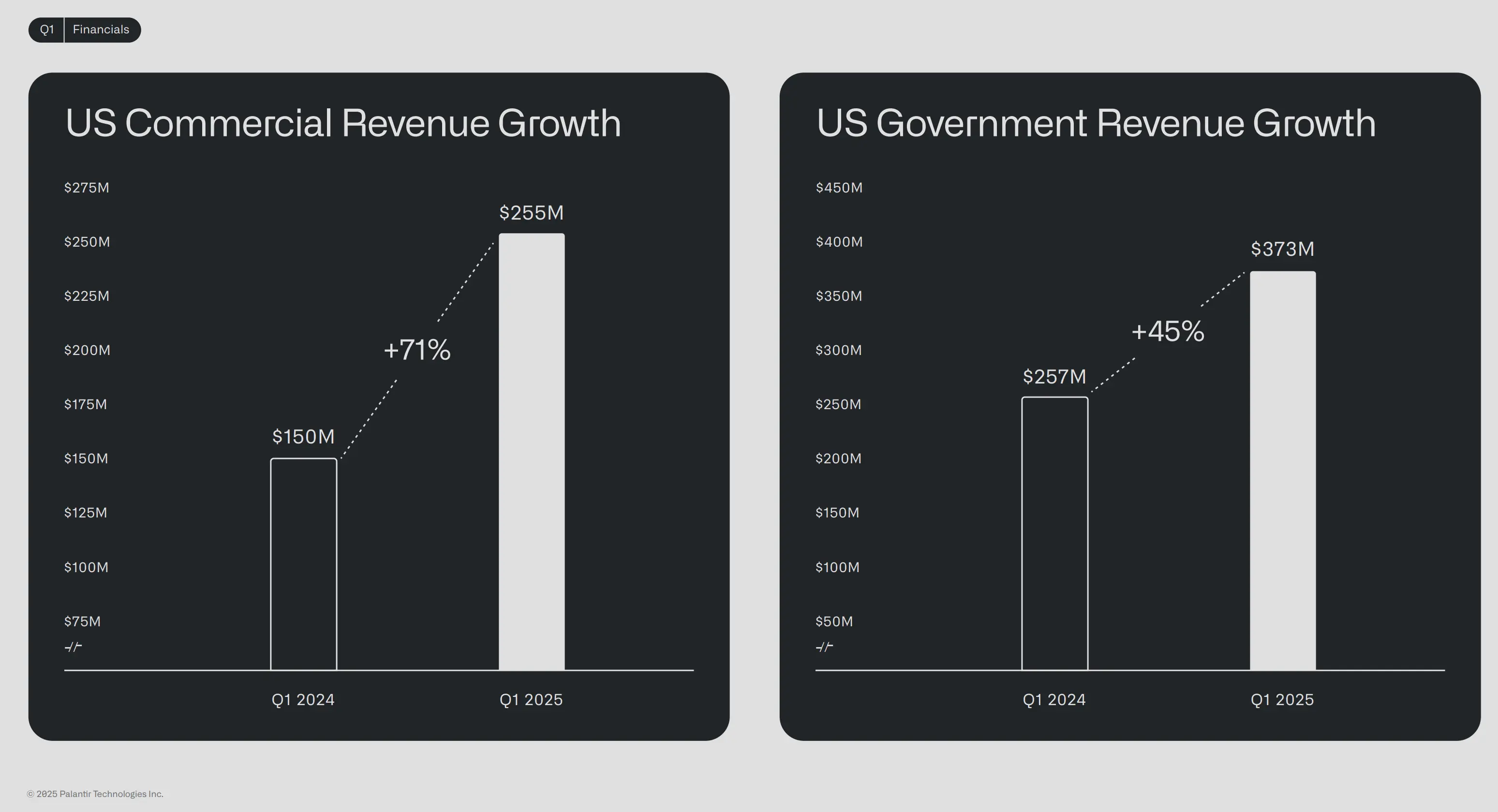

Commercial and Government Demand Soars in the U.S.

The company's U.S. operations saw particularly sharp growth. Revenue from U.S. commercial clients surged 71% to $255 million, while revenue from the U.S. government climbed 45% to $373 million — both figures exceeding analyst expectations. In total, Palantir’s customer base expanded by 39% compared to the previous year.

Rather than relying on traditional sales teams, Palantir engages potential clients through hands-on "bootcamps," where engineers work side by side with organizations to develop customized AI solutions. This approach led to 139 new contracts in Q1 valued at over $1 million, including 31 deals worth more than $10 million.

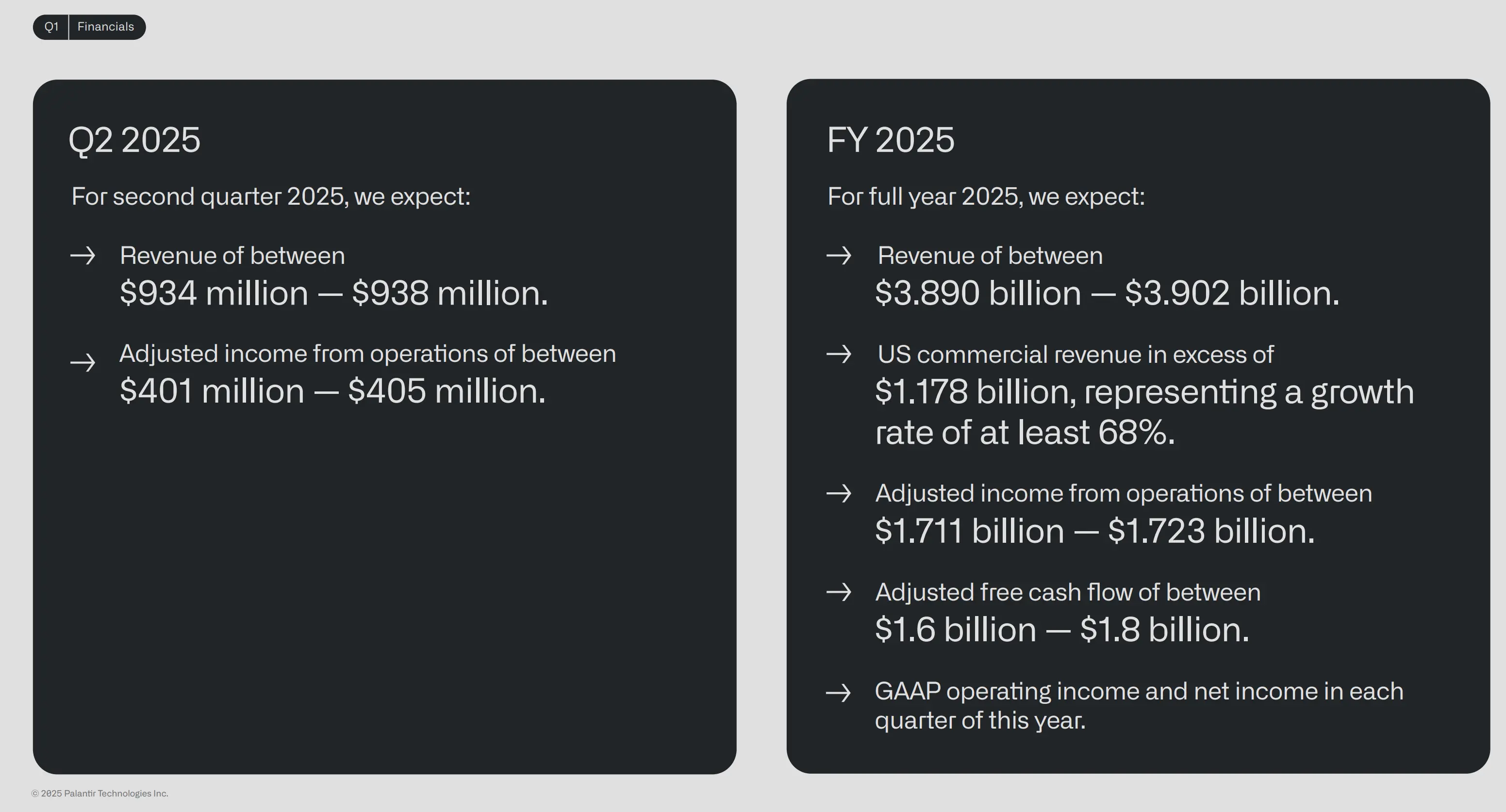

Upgraded Full-Year Guidance for 2025

On the back of its strong performance, Palantir revised its full-year revenue forecast upward to between $3.89 billion and $3.9 billion — representing a 36% increase from 2024. This outlook is well above its previous guidance of $3.74 billion to $3.76 billion and the $3.75 billion consensus forecast.

The company also raised its adjusted operating income projection to $1.71–$1.72 billion, compared to a previous estimate of $1.56–$1.57 billion. For the current quarter, Palantir expects revenue of $934–$938 million, again topping analyst expectations of $899.4 million.

Valuation Remains a Sticking Point

Despite the strong report, Palantir is currently losing more than 7% in the premarket session. Analysts point to the company’s steep valuation as a key concern. With a price-to-earnings (P/E) ratio exceeding 500 based on trailing earnings, the stock is trading at levels far above the S&P 500 average of 15–20. This premium reflects immense investor expectations — and leaves little room for error.

Founded by billionaire Peter Thiel, Palantir continues to ride the wave of AI enthusiasm. Still, as Karp reminded shareholders, its true mission extends beyond quarterly metrics. “We have grander, more idiosyncratic goals,” he wrote. “Our value will never be fully captured by earnings alone.”