Investors looking for growth chances at fair prices often use screening methods that weigh several basic factors. The "Affordable Growth" method focuses on companies showing solid expansion ability while keeping good financial condition and profit measures, all without needing high price tags. This process helps find businesses set for ongoing achievement that have not yet become too expensive due to market excitement.

Growth Path

Micron Technology Inc (NASDAQ:MU) shows notable growth traits that are central to its attraction for investors focused on expansion. The company's latest results display significant enlargement in important financial measures, with especially good outcomes in its last fiscal year.

- Earnings Per Share rose by 552.76% over the past year

- Revenue went up by 48.85% in the same time

- Past yearly EPS growth averages 23.98% over several years

- Revenue has increased at an average yearly speed of 11.76% in the past

In the future, experts predict continued expansion with earnings estimated to go up by 10.58% each year and revenue predicted to increase at 10.14% per year. This mix of good past performance and solid future estimates gives assurance in the company's capacity to keep its growth path, making it especially interesting for investors looking for companies with proven and anticipated expansion.

Valuation Check

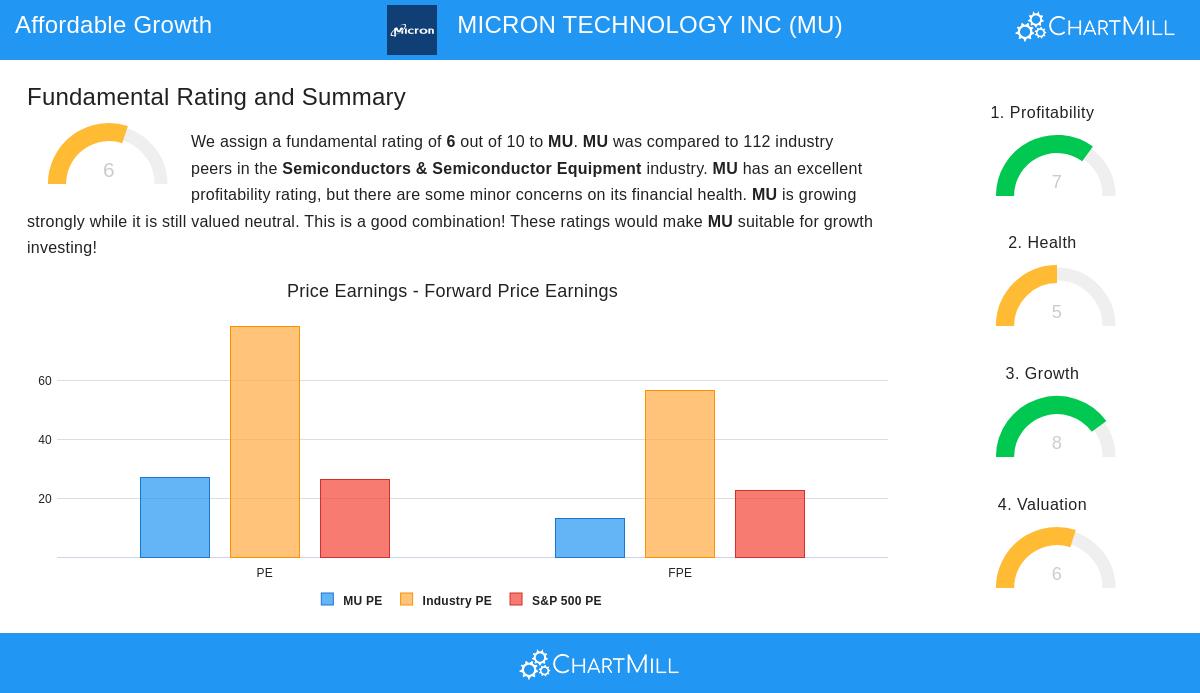

Even with its solid growth picture, Micron sells at price levels that stay sensible compared to both its field and wider market guides. The company's pricing shows a varied situation that finally backs the "affordable" part of the screening rules.

- Forward P/E ratio of 13.13 looks good next to field average of 56.38

- Current P/E ratio of 27.02 matches S&P 500 average of 26.19

- Enterprise Value to EBITDA ratio is less than 83.93% of field competitors

- PEG ratio shows payment for growth stays interesting

The price measures imply that while Micron gets some extra cost for its growth outlook, it stays fairly valued next to sector rivals. The future multiples show special worth, with the forward P/E ratio placing the company at a lower cost than 96% of its semiconductor industry equals. This price outline lets growth investors take part in the company's enlargement without paying too high multiples.

Profit and Financial Condition

Besides growth and price, Micron shows good profit numbers that back its business plan lasting power. The company's financial state displays some zones of strength next to small points that need watching.

The profit study shows several good signs:

- Return on Assets of 10.31% does better than 81% of field equals

- Return on Equity of 15.76% sits with field front runners

- Operating Margin of 26.39% is more than 85% of semiconductor firms

- Profit Margin of 22.84% puts the company in the field's top group

Financial condition gives a more detailed view with both strong points and soft spots:

- Current ratio of 2.52 shows good short-term cash flow

- Debt-to-Equity ratio of 0.26 points to workable borrowing

- Altman-Z score of 7.19 shows very low failure danger

- Some attention is needed on stock dilution and debt-to-free-cash-flow levels

The company's detailed basic study report gives more depth into these measures and what they mean for long-term investors. The pairing of very good profit with acceptable financial condition supports the investment idea that Micron has the working effectiveness to make the most of its growth chances.

Investment Points

For investors using the Affordable Growth plan, Micron stands as an interesting example in weighing growth possibility with fair price. The company's good enlargement numbers, especially in earnings and revenue growth, give the growth part key to this way. At the same time, its price multiples, mainly on a future view, stop investors from paying too much for this growth compared to field norms.

The screening way stresses that lasting growth investing needs companies to show not just enlargement possibility but also the financial base to support that growth. Micron's profit numbers point to effective actions, while its condition scores, though showing some small points, stay enough to back continued business progress. This balanced basic outline fits well with investors looking for growth chances without taking on too much price or financial danger.

Investors curious to find more companies that fit like Affordable Growth rules can look at more screening outcomes through our stock screening tools.

Disclaimer: This study is based on basic facts and screening ways for learning reasons only. It does not make up investment guidance, and investors should do their own study and think about their personal money situation before making investment choices.