Popular Screens: Swing Trading

By Aldwin Keppens - reviewed by Kristoff De Turck

Last update: Jun 30, 2023

In this article we will discuss the swing trading screen. Also check out the General Trading Tips, which gives some general pointers.

The Swing Trading screen is one of our most popular screens at the time of writing and is also the first screen in this series that was submitted by a chartmill user. A great share by this user! Not only do we like it, but also other chartmill users are expressing their appreciation by voting the screen up in the list.

Swing Trading is a very general term. In this case the screen is looking for pull backs in strong stocks. Let's have a look at the filters that are used:

- Price: Above 20, ETF: none, Average Volume: 50 SMA > 20K: These are just some general filters to avoid low priced stocks without enough liquidity. Also ETF's are avoided.

- Signal: Strong Stocks: This is one of chartmill's special filters to select only the strongest or best performing stocks in the market.

- Signal2: Near 20 day High: This filters for stocks that have their current price near a 20 day high. The filter limits the maximum distance to the 20 day high to 5%.

- SMA1: Price Below SMA 10: The stock should be below its 10 day moving average! So in the short term timeframe prices have been pulling back.

- SMA2: Price Above SMA 20: The stock should be above its 20 day moving average! So in the last couple of weeks, the stock has been going up.

The combination of these filters give you a list of recent pullbacks in the strongest stocks in the market that are still near their 20 day high. A slight variation would be to remove the 'near 20 day high' constraint and only filter on below 10 day moving average, but above 20 day MA. This gives a couple of additional results that still look fine.

Swing trading Results

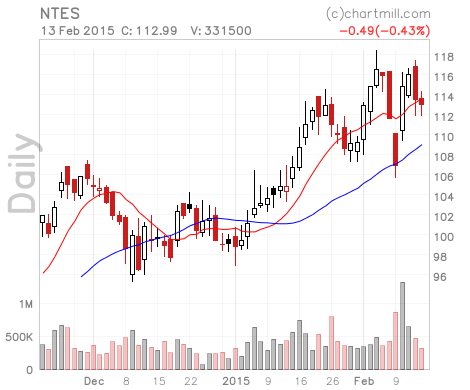

NTES is one of the results when running the screen today.

In the beginning of February, we see a new high was made, followed by a rather strong sell off, which was again followed by a rather strong return to the highs. And in the recent today there was again a pull back, but this time on lower volume.

UNA.AS is another result of the screen, showing a rather clean pull back after a strong run up.